Malaysia’s einvoicing initiative marks a major step in the country’s broader push toward digital tax administration and real-time visibility into business transactions. For companies operating in or trading with Malaysia, e-invoicing is no longer a future consideration — it is a compliance reality that requires careful preparation, system alignment, and strategic execution.

While regulatory mandates can often feel like a burden, organizations that approach Malaysia’s e-invoicing requirements proactively have an opportunity to simplify invoicing operations, reduce manual processes, and build a more scalable foundation for future compliance across the region.

What’s required in Malaysia’s e-invoicing mandate?

Since August 2024, Malaysia has been rolling out mandatory electronic invoicing (e-invoicing) as part of a phased national compliance program. The mandate requires B2B, B2C, and B2G transactions to be issued in structured digital formats containing prescribed tax data and submitted to the Inland Revenue Board of Malaysia (LHDN) for real-time or near-real-time validation.

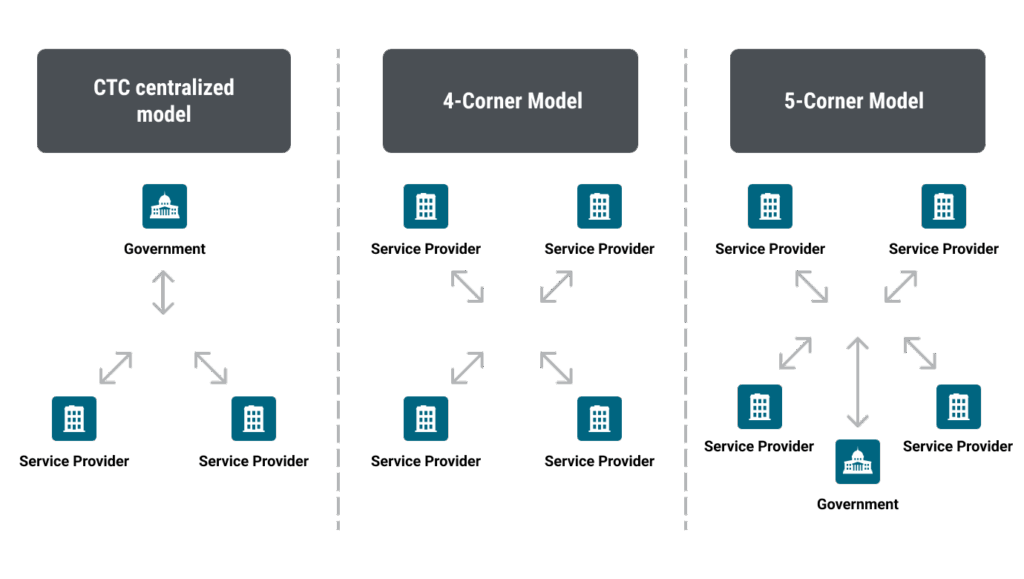

Around the world, countries adopt different e-invoicing models, ranging from centralized CTC frameworks where invoices are cleared by tax authorities before delivery, to decentralized 4corner models enabling direct exchange via service providers, and 5-corner models that blend both approaches by adding real-time government oversight without disrupting peer-to-peer exchange.

Malaysia has adopted a pre-clearance model similar to other CTC regimes worldwide, such as France, Italy, Romania, or Poland. Every invoice must be submitted to the Inland Revenue Board of Malaysia (LHDN) through the MyInvois system for validation before being shared with the buyer.

Malaysia’s e-invoicing requirements and specifications are as follows:

- Applies to B2B, B2C, and B2G transactions

- Invoice format: XML or JSON, following LHDN‑defined schemas

- Each validated invoice receives a unique ID and QR code

- Integration options: MyInvois Portal (manual) or API integration for automation

Dive deeper: Overview of the e-Invoice Model | Lembaga Hasil Dalam Negeri Malaysia

Malaysia’s e-invoicing timeline

The rollout is phased by annual turnover (FY2022):

| Phase | Annual turnover | Mandatory date | Grace period ends |

| Phase 1 | > RM100M | Aug 1, 2024 | Jan 31, 2025 |

| Phase 2 | RM25M–RM100M | Jan 1, 2025 | Jun 30, 2025 |

| Phase 3 | RM5M–RM25M | Jul 1, 2025 | Dec 31, 2025 |

| Phase 4 | RM1M–RM5M | Jan 1, 2026 | Jun 30, 2026 |

| Phase 5 | Up to RM1M | Exempt (threshold raised Dec 2025) | N/A |

Action point: If your turnover is between RM1M and RM5M, the grace period for compliance ends in less than six months.

Exemptions: Businesses with annual turnover below RM1 million are below scope. In December 2025, the Malaysian government approved raising the e‑invoicing exemption threshold from RM500,000, following SME feedback on cost and readiness concerns.

This means that many Malaysian micro‑enterprises that were preparing for later phases no longer need to implement e‑invoicing — at least for now.

Where do I start? Best practices for sustainable e-invoicing compliance

To prepare for Malaysia’s e‑invoicing requirements, we recommend that organizations adopt a structured, forward‑looking approach — not a short‑term patch designed only to meet the next deadline.

Based on experience supporting global deployments, several best practices stand out:

1. Start with invoice reception and reporting

Even organizations that aren’t immediately subject to full issuance mandates should make sure they are able to receive and process compliant e‑invoices. Establishing a reliable inbound flow is often the fastest way to reduce risk and create internal alignment.

2. Decouple compliance from core systems

Hard‑coding regulatory logic into ERP or finance systems may solve today’s requirement, but it rarely scales. A centralized e‑invoicing layer that aligns with operational flows allows businesses to adapt to new formats, schemas, and reporting rules without disrupting finance operations.

3. Design once, reuse everywhere

Malaysia’s mandate should be viewed as part of a broader regional and global compliance trajectory. Just in the surrounding region, other countries implementing e-invoicing mandates include Indonesia, Vietnam, the Philippines, and Singapore. Leveraging reusable standards, mappings, and integration patterns makes it easier to onboard additional countries and mandates over time.

See also: Navigate e-Invoicing Mandates Around the World with Axway

4. Work with experts who monitor regulatory change

Regulations evolve. Message schemas change. Validation rules are refined. Partnering with specialists who actively track and manage these changes significantly reduces long‑term compliance risk.

With strong regional expertise, including work with ASEAN initiatives to replace manual processes with digital platforms, Axway is an ideal partner for organizations looking to modernize B2B flows while managing global compliance obligations, and e-invoicing is no exception.

How Axway helps organizations stay compliant — in Malaysia and beyond

Axway eInvoicing enables businesses to manage multiple country‑specific e‑invoicing requirements through a single, standardized platform.

By transforming invoice data into locally compliant formats and managing connectivity with tax platforms and service providers, Axway helps organizations reduce cost, risk, and operational burden.

Malaysia’s mandate illustrates a broader global pattern: structured data, real-time validation, and continuous controls are becoming the norm. This is why more and more companies are opting for a centralized, standards-based e-invoicing approach that decouples regulatory change from core ERP systems.

The country’s final e-invoicing deadlines are approaching fast, with most of them already in force. Don’t wait until the last minute: let Axway’s experts help you plan your integration strategy today.

Learn more about Axway eInvoicing and how we can help you stay compliant and competitive.