A perfect storm is “an event in which a rare combination of circumstances drastically aggravates the event.”

After interviewing a meteorologist about the 1991 Halloween Nor’easter, author Sebastian Junger describes three different weather-related phenomena that created the “perfect situation” for such a storm:

- Warm air from a low-pressure system coming from one direction.

- A flow of cool and dry air generated by a high-pressure from another direction.

- Tropical moisture provided by Hurricane Grace.

For Healthcare in 2020, the perfect storm comes in like a 1, 2, 3 punch.

INTEROPERABILITY STANDARDS (warm air from a low-pressure system coming from one direction)

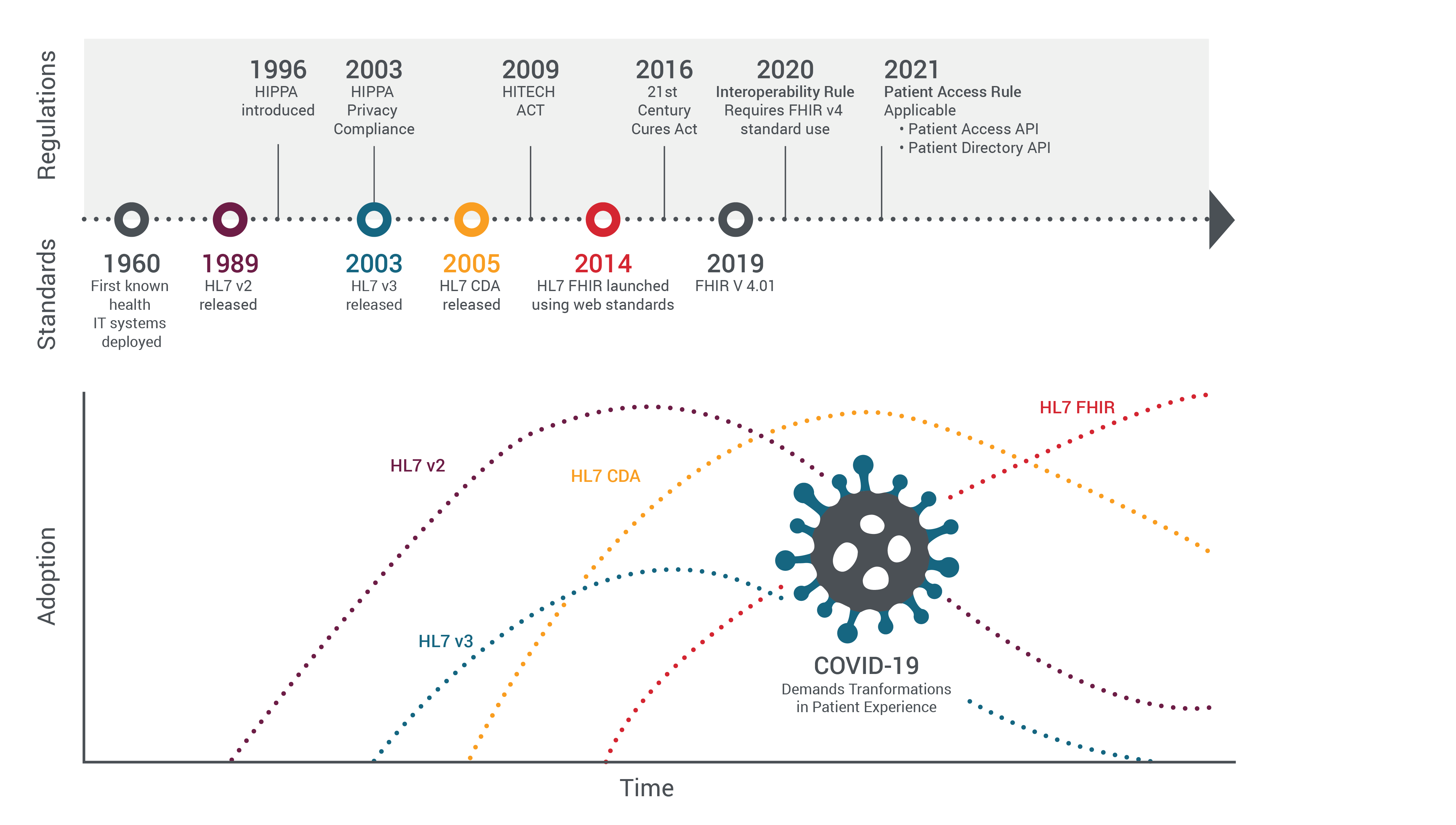

Early interoperability standards in HC were onerous and heavy but also necessary. HL7 V2 came to maturity in the 90s. It was 80% standard and 20% a framework.

V2 lacked a consistent data model and had many more challenges but represented the complex world of healthcare. Interoperability was a science project.

HL7 V3 came along at the turn of the century to address the v2 challenges but did not provide backward compatibility. V3 presented itself as more of a standard than a framework for negotiation.

Even with this V3 had limited adoption as V2 had at this point taken off… that is until the 2005 Clinical Document Architecture (CDA) came along which focused on patient documents at a given point in time and focused content being more human-readable. This addressed portability of your health data and CDA accelerated.

HL7 at this point remained asynchronous. Multiple workflows were needed for a single transaction over heavy point-to-point connections. Interoperability remained a science project.

Enter FHIR® (Fast Healthcare Interoperability Resource). FHIR® is unique over efforts of the past as it’s based on web standards — REST, JSON, OAuth, and HTTP.

Have you heard of APIs? FHIR® is API-based and as such FHIR® is synchronous, it‘s lightweight and query-based. FHIR®s implementation is poised to support rapid adoption.

FHIR® on this basis opens up healthcare interoperability to real-time access to quality data. FHIR® is also mobile-friendly another huge benefit to meet emerging requirements for innovation in healthcare so much that it is embraced by Apple directly inside of iOS.

A low-pressure system

MANDATES (a flow of cool and dry air generated by a high-pressure from another direction)

HIPAA (Health Insurance Portability and Accountability Act of 1996) made everything about your healthcare a secret. Its initial focus was to protect health insurance coverage for those changing jobs.

HIPAA tied in protecting your private health information and through this drove the use of interoperability standards for securing your healthcare data. HIPAA came in two parts — the Privacy Rule and the Security Rule. The scope of HIPAA with this was great and the collective implementation onerous.

For healthcare organizations, this was all about compliance and a massive administrative burden. If your organization experienced a data breach, HIPAA fines and negative publicity could be disastrous.

In 2009 came the Health Information Technology for Economic and Clinical Health Act. The HITECH act for short. HITECH was signed into law to promote the “Adoption and meaningful use of health information technology.”

HITECH was a significant milestone. HITECH standardized the healthcare data language/vocabulary, it drove the adoption of EHR technology; it drove information sharing, and it drove interoperability even mandating the use of the clinical document format (CDA).

HITECH came with significant financial incentives often referred to as HITECH’s carrot. HITECH also came with a big stick with fines for the non-adoption of EHRs. Further, it mandated audits of healthcare providers for compliance with HIPAA’s privacy and security rules with high fines for non-compliance.

High fines. High pressure.

In 2016 came the 21st Century Cures Act. Within is a focus to accelerate research and curing diseases but this too promoted the use of technology to “Reduce the burdens relating to the use of electronic health records (EHR).”

With this, the act was promoted for nationwide interoperability and spoke directly against information blocking. Directly in this bill are statements about the integration of health IT and its transmitting and receiving of data.

But not only integration between health systems, but many big words in here also lead to emphasis for patients being able to access their electronic health information directly in a way that is “easy to understand, secure and updated automatically.” And not only patients but this act provides for caregivers as well.

Pressure amounts...

Then in 2020 — the interoperability rule, the regulations mandated by the 21st Century Cures Act were published. This rule has a different flavor to it. The interoperability rule focuses on putting patients FIRST and doing so by giving patients — YOU — access to your health information when you need it and, in a way, you can use it. And then this rule mandates FHIR v4 and explicitly states the use of APIs!

Here we go! The government has mandated the interoperability rule. FHIR®, Open API, standardized data sets are needed. The rule calls for a Patient Access API and a Provider Directory API amongst other things…

A high-pressure system.

COVID DEMANDS INNOVATION IN HEALTHCARE (tropical moisture provided by a Hurricane)

And then comes the hurricane. Hurricane COVID-19!

COVID-19 has disrupted every industry across the globe and forced organizations to be digital overnight. Leaders will emerge from this only by being nimble, adapting their business models, adapting their customer engagement models, and adapting their employee’s engagement. Now more than ever experiences will be king. A couple of data points:

- A recent survey of CEOs conducted by Fortune magazine and showed that 77% of CEOs reported that the COVID-19 crisis accelerated their digital transformation plans and that 40% are spending more on IT infrastructure/platforms.

- Twilio released its Covid-19 Digital Engagement Report a global survey of 2,500 enterprise decision-makers — their findings “COVID-19 accelerated companies’ digital communications strategy by an average of six years while 97% of enterprise decision-makers believe the pandemic sped up their company’s digital transformation.”

What do you think? Does this apply to healthcare? Absolutely. Healthcare went virtual almost overnight. A McKinsey report finds a shift from 11% of respondents using telehealth in 2019 to 46% use in June 2020 and 76% stating they are highly or moderately likely to use telehealth in the future.

A forced shift and guess what — we like it! And providers are responding in kind with 57% viewing telehealth more favorably than they did pre COVID-19 and 64% being more comfortable using it.

Modern Healthcare declared that “very few things could rival COVID-19 for catalyzing and accelerating the long-anticipated transformation of healthcare.” There’s no back to normal once the crisis is over.

For far too long, our industry has been stuck in a stagnant paradigm. We talked about real change, but we didn’t change. Then suddenly, everything changed.”

The Perfect Storm?

All analogies breakdown. And here this one does. Why? The term “Perfect Storm” is also used to define a worst-case scenario and I argue this can create a best-case scenario. It creates the ideal storm of opportunity.

Think the mix of (1) availability of web-based FHIR® standards that are lightweight, mobile-friendly, and quick to implement; (2) the interoperability rule mandates open APIs and restricts information blocking (naming FHIR® use); and (3) the urgency to innovate.

These three line up perfectly for creative healthcare companies to rise and shine. This creates a shift from what was the interoperability and compliance burden, to now innovation opportunity to power the patient and clinician experience that these unprecedented times demand.

At the base, sure, the Government has mandated the interoperability rule and FHIR®, Open API, and standardized data sets.

Yes, I need to be compliant. BUT more pertinent is my need to create experiences and with this compliance, I can serve this greater need.

How do I stand up an app for patients to get to my telehealth platform and then get over to my platform to schedule an appointment?

How do I tell them they can be ready to come to the doctor’s office and ask them online screening questions — have you traveled outside the country? Do you have COVID symptoms?

How do I create the app, route the data? And I must do this on a time scale of days now? This is more than just setting up an FHIR® server.

The ability to address innovation in healthcare comes from API Platforms working in conjunction with the FHIR® support in EHR systems. Again, the Interoperability rule mandates Open APIs.

The Interoperability Rule does not mandate how you do APIs well or how you support the developer community — the ecosystem. An API Platform and a proper API program can lead you from the compliance checkbox to success.

Read more about health as a service platform.