As the clock ticks toward the French government’s mandatory e-invoicing and e-reporting rollout starting in 2026, many companies are scrambling to prepare for compliance. But what if we told you that this change isn’t just a regulatory hurdle — it’s actually a strategic opportunity?

E-invoicing is not just about compliance. For forward-thinking businesses, it’s a catalyst for digital transformation, automation, and improved financial agility.

E-Invoicing in France: a regulatory push with strategic potential

Under the Loi de Finances 2024, e-invoicing and e-reporting will become mandatory for all French businesses in a phased approach between 2026 and 2027. The government’s objectives are to:

- Improve VAT collection through real-time reporting

- Modernize and digitize B2B financial flows

But this shift also offers companies a powerful opportunity to rethink their invoice management processes and identify potential efficiencies.

Turning compliance into business value

- Automate and streamline invoice processing

Manual invoice handling often leads to errors, delays, and higher costs. E-invoicing eliminates paper-based steps, enabling automated invoice validation, approval, and archiving. This automation frees up teams to focus on higher-value tasks rather than chasing paper or fixing mistakes.

- Reduce costs and accelerate cash flow

Digital invoices reduce processing costs compared to traditional paper methods. Additionally, faster approval cycles and real-time visibility into payments help reduce Days Sales Outstanding (DSO) improving cash flow.

- Strengthen supplier and customer relationships

With better invoice accuracy and transparency, disputes over payments decline. E-invoicing platforms provide all parties with real-time status updates, enabling smoother collaboration and enhanced trust between businesses and their trading partners.

- Enhance compliance and data security

E-invoicing platforms ensure that your company’s data is handled securely, compliant with GDPR and French tax regulations. The integration with government PAs means full traceability and audit readiness, reducing risks of fines or penalties.

Understanding the e-invoicing landscape: global models and France’s unique approach

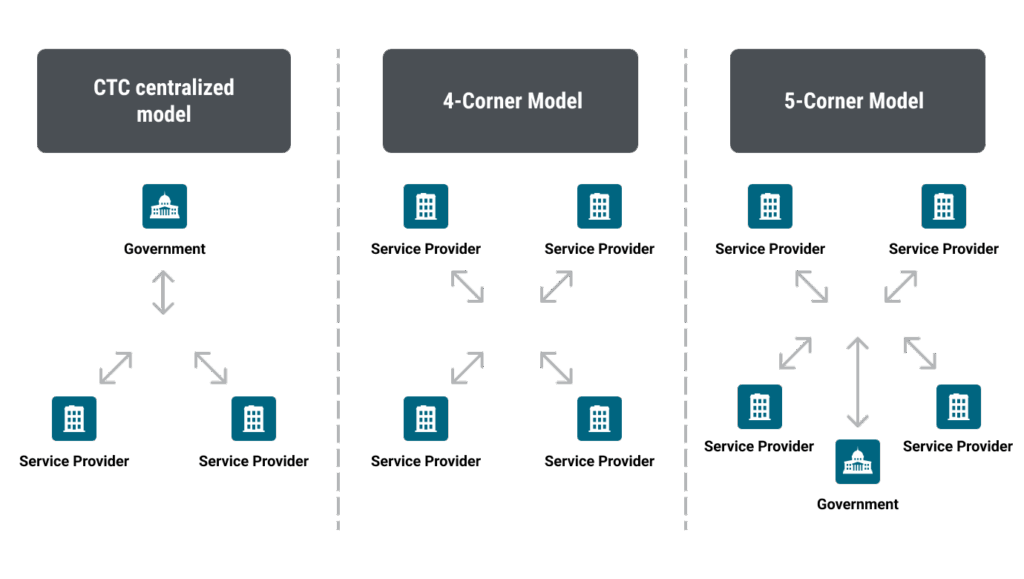

Around the world, different countries are adopting different models for e-invoicing:

- CTC centralized model (e.g., Italy, Romania, Poland, Malaysia): Invoices are validated by a central tax platform before reaching the buyer.

- 4-corner model: Common in countries like Germany, Singapore, or Japan — this model involves direct exchanges between suppliers and buyers via service providers.

- 5-corner model: An evolution of the 4-corner model, involving an additional node — the government or a certified platform — ensuring real-time reporting while preserving decentralized exchange.

How e-invoicing works in France: the 5-corner model

France is adopting the 5-Corner Model for its 2026 e-invoicing mandate — combining transparency, interoperability, and real-time reporting.

Here’s how it works:

- Suppliers and buyers send and receive invoices via certified platforms called PAs (Plateformes Agréées) – formerly called PDPs, plateformes de dématérialisation partenaires.

- These PAs exchange invoices and report key data to the government’s central portal (PPF).

- This ensures real-time VAT control while letting businesses keep their existing workflows.

France’s rollout starts in 2026 with large and mid-sized companies, expanding to all businesses by 2027. This phased approach enables France to strike a careful balance between achieving full government visibility into business activities and minimizing disruptions to day-to-day operations, thereby supporting both regulatory oversight and business continuity.

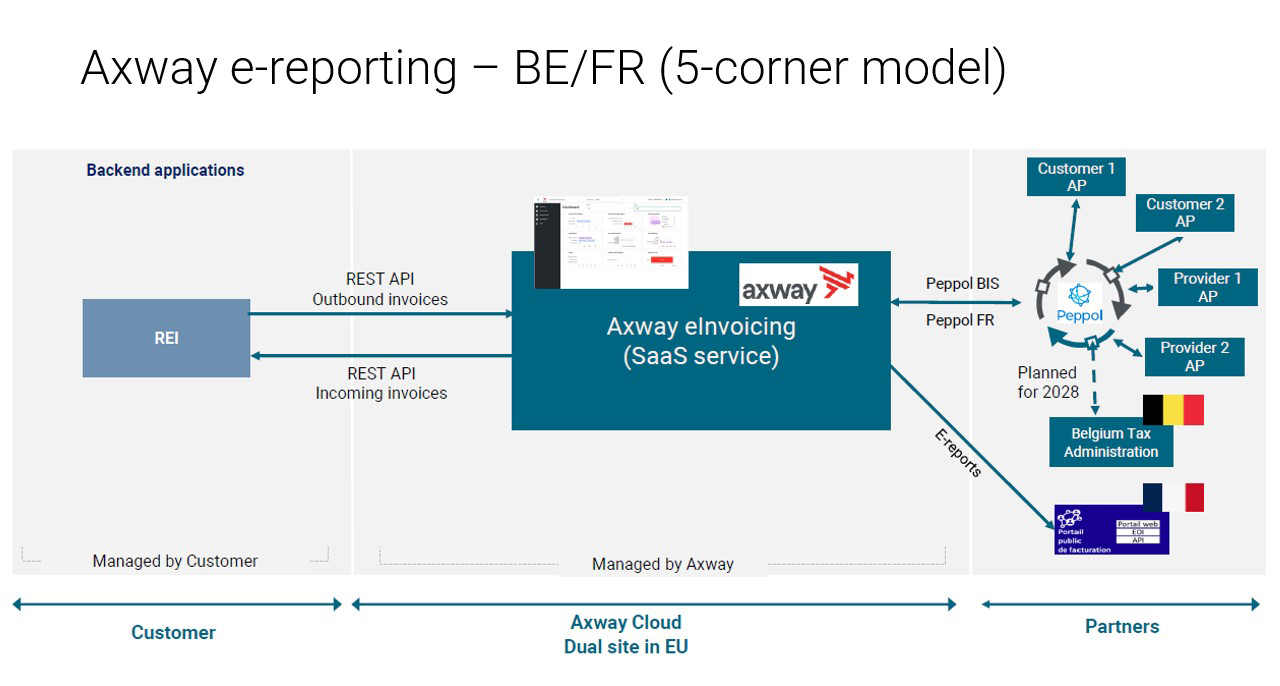

Axway is a government-certified PA (Approved Platforms, formerly Partner Dematerialization Platform) in France, officially authorized to handle compliant e-invoicing and e-reporting as part of the 2026 mandate. It offers a complete, ready-to-use solution that helps businesses validate and deliver e-invoices, report data to tax authorities, and stay compliant with French regulations.

Axway’s platform integrates easily with any ERP system, supports all required formats like UBL, Factur-X, and EDIFACT, and connects with other PAs and Peppol for smooth invoice exchange. It also manages the full invoice lifecycle, detects duplicates, handles exceptions, and provides dashboards for full visibility.

With secure, legally compliant archiving and support for multi-entity environments, Axway simplifies compliance while helping businesses automate and streamline invoicing processes across borders.

Why Axway is the right partner for e-invoicing in France and beyond

Choosing the right e-invoicing partner means more than features — it’s about reliability, flexibility, and global readiness.

This is why Axway stands out:

- Global compliance: Axway ensures out-of-the-box compliance with e-invoicing regulations in over 20 countries, including Europe, LATAM, and Asia — all from a single, scalable cloud platform.

- Built into a proven B2B integration platform: Unlike e-invoicing-only providers, Axway leverages decades of B2B integration expertise to allow businesses with international operations to manage various e-invoicing mandates in the countries they operate and connect these processes with B2B integration flows — eliminating silos and enabling true end-to-end automation

- Full support for French PAs: Axway integrates seamlessly with all certified French Plateformes Agréées (PA), helping you meet France’s e-invoicing mandates with ease.

- Flexible integration: Works with any ERP or back-office system, supports multi-entity and multi-country invoicing, and covers all major e-invoicing models including clearance, CTC, and post-audit.

- Future-Proof & easy to use: Built on open formats (UBL, Factur-X, CII, EDIFACT) and protocols like Peppol, Axway stays ahead of regulatory changes and country-specific rules keeping you compliant as regulations evolve.

Take the next step: embrace e-invoicing as a growth driver

Complying with France’s e-invoicing mandate is non-negotiable, but it doesn’t have to be a chore. Forward-thinking companies use this as an opportunity to digitize finance, reduce operational overhead, and build stronger business relationships.

With Axway as your e-invoicing partner, your business can turn compliance into a competitive advantage — faster payments, reduced errors, and enhanced data insights all contribute to a healthier bottom line.

Ready to transform your invoicing process with Axway eInvoicing?