Starting in January 2025, private companies in Germany must be prepared to receive e-invoices in a structured format compliant with the XRechnung specifications, as outlined by the European Norm EN-16931. While the guidelines allow some flexibility in how these invoices are transferred from supplier to buyer, this flexibility can lead to increased complexity and costs unless businesses proactively adopt the right strategy.

Lesen Sie diesen Artikel auf Deutsch.

Given the global trend towards e-invoicing, it’s crucial for companies to think beyond the immediate requirements of the German market. E-invoicing is becoming a standard tool for VAT administrations to secure revenue, but it also offers businesses an opportunity to streamline and future-proof their financial processes. Below, we provide practical advice to help buyers prepare for the upcoming B2B e-invoicing mandate in Germany.

Structured e-invoices are not entirely new. Many businesses, particularly those involved in Business-to-Government (B2G) transactions, are already familiar with them. The EN-16931 standard, which is mandatory for public entities, allows for two XML syntaxes: UBL and CII. In Germany, the ZUGferd format, a hybrid of PDF and structured CII invoice, is also commonly used.

Note: this blog focuses on Germany’s B2B e-invoicing mandate. For more on the B2G e-invoicing mandate, read this blog.

What’s new with the mandate is that businesses must now be ready to handle both e-invoices and traditional PDF invoices simultaneously. This marks the beginning of a transition period towards a fully digital era in invoicing.

With the deadline fast approaching, now is the time to take control of your e-invoicing strategy to ensure compliance and prepare your business for the future.

Organize invoice reception

1. Review your current exchange methods

As January 2025 nears, it’s essential to organize your e-invoicing processes for B2B transactions. Many organizations have already invested in automation tools like EDI and supplier portals. However, for the majority of companies, email is often seen as the easiest way forward.

While email may appear convenient, it comes with several challenges that can complicate your invoicing process.

- PDF style invoices mixed with e-invoices : Businesses will need to distinguish between PDF invoices, which lack structured data, and new e-invoices containing digital format.

- Validation of sender: Validating the sender and the integrity of the invoice is crucial to ensure that the invoice is authentic and has not been tampered with.

- Validation of invoices : Buyers are responsible for verifying that the invoice meets XRechnung requirements, including the correct profile used in ZUGferd invoices.

- Addressing: Buyers need at least to provide a separate e-mail address per legal entity. More complex businesses sometimes expose multiple addresses to help separate different invoice types or back-office interfaces. Additional controls are needed to make sure suppliers do not send to the wrong mailbox.

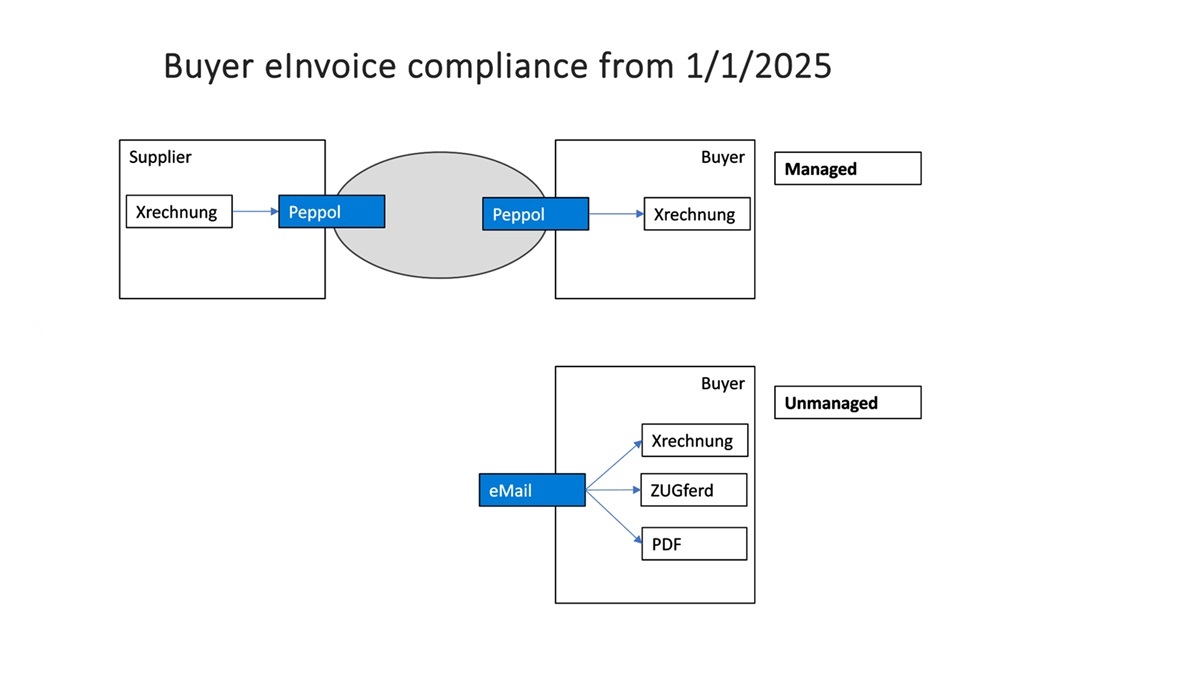

These challenges make email a complex, unmanaged, and potentially risky channel for receiving structured e-invoices.

To mitigate these risks, businesses need to define and implement specific procedures for handling any issues that arise—an effort that can be costly and time-consuming.

2. Activate Peppol network for receiving e-invoices

The Peppol network offers a more structured and compliant approach to e-invoicing. As a digital trading network based on the European Invoice Framework, Peppol provides built-in features for non-repudiation and data integrity, addressing many of the challenges associated with using email for e-invoice reception.

When you adopt Peppol, your invoices are validated before they are delivered, ensuring that any issues are identified and rectified by the supplier before the invoice reaches you. This reduces the administrative burden on your team and ensures that only compliant invoices are accepted.

Furthermore, Peppol’s address book (companies in Germany typically use VAT registration number) helps ensure that invoices are delivered to the correct recipient, further simplifying the process.

Implementing Peppol is not only a smart choice for compliance—it’s also straightforward. Most businesses can be up and running on Peppol within just a couple of days, making it an efficient solution for meeting the January 2025 deadline. With Peppol, you can be confident that your e-invoicing processes are secure, compliant, and ready for worldwide deployments.

Managed vs unmanaged

What to do with the e-invoice once properly received?

Once an e-invoice is successfully received, the next step is to decide how to handle it within your organization. By January 2025, the primary concern will be ensuring your ability to receive electronic invoices. However, to fully realize the benefits of digital invoicing, such as increased efficiency and reduced costs, your back-office systems must be ready to process these invoices effectively.

The first requirement is to preserve the digital content of the e-invoice through proper archiving.

If your Accounts Payable department is already operating in a paperless environment, using tools that extract data from PDF invoices and apply approval workflows, you have a couple of options:

- You can either continue processing e-invoices using your current methods, injecting the e-invoices in parallel which might involve converting them into PDFs or even handling them manually.

- Or, you can also upgrade your existing systems to fully embrace e-invoicing, applying the same rules and validations used for EN-16931 and XRechnung standards.

The choice is not if but when you will make your back-office fully prepared for digital processing. And this can be according to a different timeline, also taking into consideration other international requirements. However, we strongly encourage you to start planning now, well before the January 2025 deadline, to avoid being forced into costly last-minute decisions.

Design and implement your own path to German e-invoicing compliance

To ensure your business is ready for Germany’s B2B e-invoicing mandate, we recommend a two-pronged approach: first, organize your e-invoice reception processes, and second, independently adapt your back-office systems to handle these invoices efficiently.

The exact path you take will depend on your current setup and unique needs, but with careful planning, you can ensure compliance and position your company to benefit from a fully digital invoicing process.

At Axway, our e-invoicing experts and partner ecosystem can help you design and implement a solution tailored to your specific requirements. With the expectation that all EU countries will operate under a B2B e-invoicing standard by 2030, it’s more important than ever to develop a strategy based on reusable standards and best practices.

Axway eInvoicing enables companies to fully embrace the German mandates and to comply with an evolving list of B2B and B2G invoicing requirements worldwide. Our cloud-based solution is fully integrated with existing e-invoicing regulations, offering continuous compliance and the agility to meet diverse and evolving national and legal requirements now and in the future.

With only a few months left before the January 2025 compliance deadline, there’s no time to waste. Contact us and take control of your e-invoicing process today to ensure not only local and global compliance but also maximized efficiency and cost reduction with a 100% digital solution.