An API marketplace is the key to taking your API strategy to the next level. It brings together all your APIs, packaged and ready to go. It gives you better tools to solve issues around governance, security, productization, and monetization.

If you want to drive development and revenue faster with your APIs, here’s how an API marketplace can help.

What is an API marketplace?

In its simplest form, an API marketplace is where you collect, package, and expose the API products you want others to discover and use. Audiences can range from internal developers in different business units, to trusted partners, to third-party app developers looking to adopt your API as a service that delivers business value.

You might think that sounds like an API portal, but there’s a big difference. While a portal focuses on APIs as a technical interface and is predominantly for internal use cases, a marketplace focuses on API products as business services for external users.

Treating APIs as products has immense value for your internal efficiency as well, ultimately leading to indirect monetization. More on that later.

See also: Top seven reasons your API developer portal is failing

Marketplaces have features that enable API product managers to curate products from multiple lower-level APIs. They also offer discovery, subscription, security, and monetization options to drive revenue – directly or indirectly – from their usage.

There are two major types of API marketplaces: public and private.

Public marketplaces bring APIs from multiple providers into one place — a sort of street bazaar where you’ll find “joke of the day” APIs right next to “payment” APIs.

Private marketplaces are sponsored by a single enterprise and offer a totally branded experience designed to drive digital business initiatives and revenue.

What problems can an API marketplace help solve?

Several factors typically trigger a company’s search for an API marketplace:

- The shift from API production to API consumption: digital business initiatives depend on APIs getting wider adoption and use

- API sprawl and complexity: a diverse API technology landscape (multiple APIM solutions, API portals, deployment methods) makes it hard to find, manage, and track all APIs

- Emerging role of API product managers: the need to build and promote API products — driven by lines of business, not just IT — that are linked to business outcomes

- Developer experience: to drive adoption, organizations are realizing they need to simplify the developer experience with common documentation, examples, community, and subscription, and start to generate and improve important metrics like time-to-first API call

Dive deeper with 10 things you need to know about an API marketplace.

Let’s take a look at the pain points API marketplaces can alleviate.

API governance

Considering the explosive growth of APIs, modern enterprises face new challenges in managing them. Many lack a single registry or catalog for all their approved API services.

API discovery is rarely automated, so it’s not even clear to product managers or developers what APIs already exist and are safe to use.

Dive Deeper into API Governance at the Enterprise Level

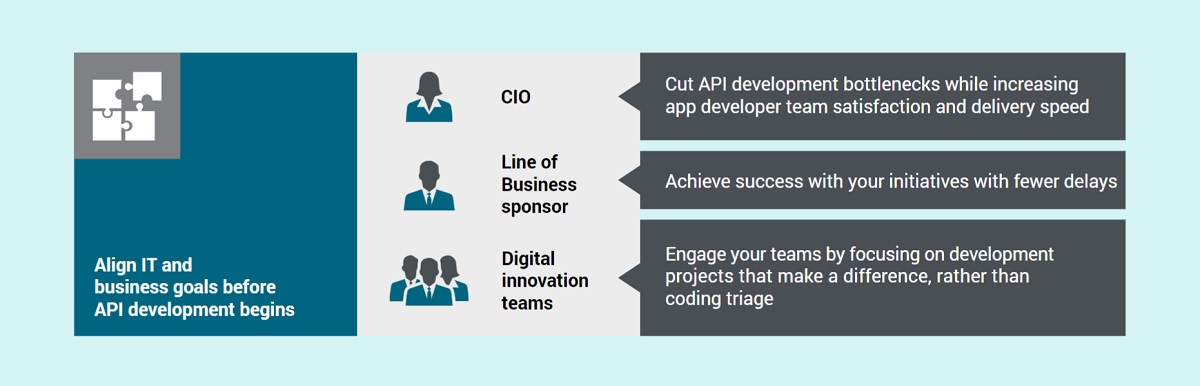

Then, there’s the fact that API governance functions tend to be distributed among development teams. Forget any kind of coordination between IT and business.

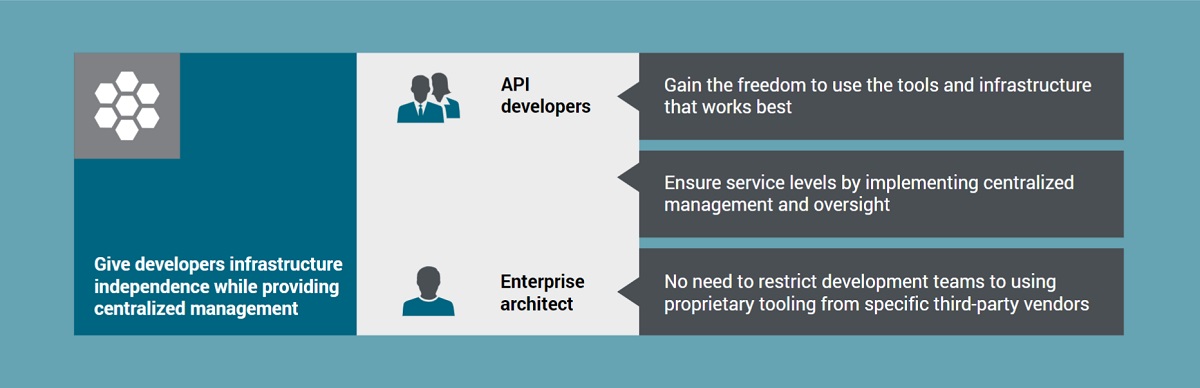

An API marketplace can simplify the discovery and use of your APIS by unifying them in a single location that encourages their adoption and enhances their management and security – regardless of style (REST, events, GraphQL), deployment (cloud, on-prem, or both) or vendor platform (AWS, Mulesoft, Azure, Software AG, Kong…).

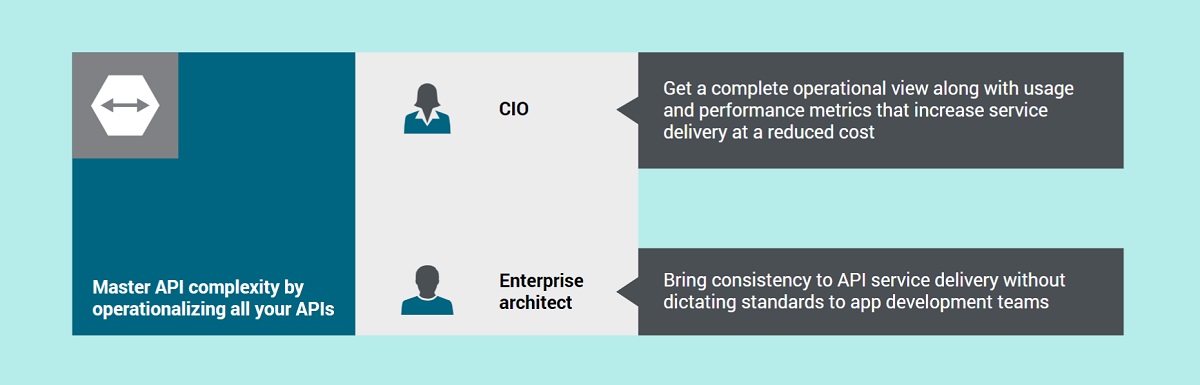

With a universal API management platform as its foundation, an API marketplace gives enterprises a single source of truth regarding all facets of their APIs. Comprehensive dashboards can produce a clear picture of API adoption, usage, and performance to help IT and business leaders make smarter API investment decisions.

Time is running out: 3 reasons to adopt universal API management now

API security

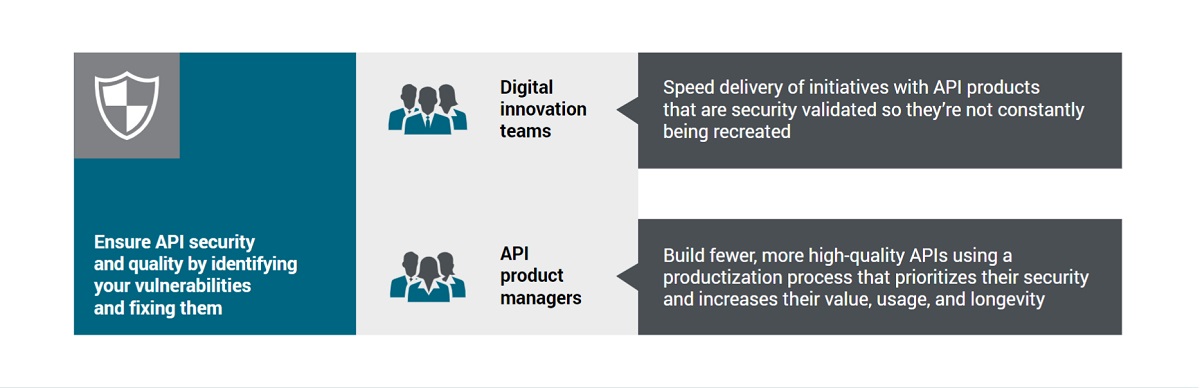

How effective your IT teams are at governing APIs throughout multiple gateways, infrastructures, and developers has a direct effect on how well your company can overcome challenges to API security.

API Security Tools and Best Practices

With no API left behind – when every API is known and secured – you’re better able to not only manage what you have, but also remediate any unmanaged or unknown APIs.

Making sure APIs are protected requires a multi-layered defense that starts with centralized API management and includes measures to establish a robust fortress around your data.

Some API teams make the mistake of only protecting external-facing APIs – for example, with authentication and authorization security behind an API gateway. But hackers don’t discriminate between internal and external digital assets. Security vulnerabilities will continue to exist.

An API marketplace accounts for that. Built-in capabilities for access control, data privacy, and threat mitigation can automatically scan API assets for compliance with security and design policy, as well as monitor network activity to identify unmanaged API traffic.

Your marketplace should be designed to ensure your APIs adhere to the highest security standards based on your digital infrastructure, so you gain the visibility and control needed to develop and deliver secure APIs faster.

API productization

Your APIs are products. Treating them that way pays off, both internally and externally.

Explore API Productization In More Depth

If developers can easily find and use proven API products that are validated, fully documented, and production-ready, your organization can speed delivery of digital initiatives and drive API value.

An API marketplace lays the groundwork for treating APIs as products. It lets you build API products by linking multiple API assets to create a digital business service that can be marketed and monetized.

See also: Understanding the role of the API Product Manager

You can select APIs from across your distributed platforms, group them by domain or target audience, and document their value and engagement instructions. Implement whatever API styles and deployment architectures developers want to use.

Then, create and manage API products with subscription plans for monetization and publish them to your API marketplace for easy consumption by developers everywhere.

Which brings us to…

API monetization

Approaching your APIs as marketable products prepares you to capture new revenue streams.

In a marketplace, API products can be curated and presented to internal and external app developers in a contextual way — complete with use case documentation — so they’re easier to find, adopt, and use. This accelerates time-to-market for your digital services.

Explore API Monetization From A to Z

Internally, it’s important for IT and business to be aligned on what needs to be built and how success will be measured. Having observability can give you insights into all API usage and performance to see if targeted outcomes are being met. And enterprises can quantify the value of their APIs through chargeback or monetization.

You can monetize APIs directly by offering external subscription plans for accessing and using your API products, or indirectly by boosting API and business performance internally and realizing greater ROI for the enterprise as a result.

See also: 5 ways enterprises are monetizing APIs

API maturity check: 3 questions to ask to see if you need an API marketplace

- Is my API program starting to shift to external partners from just internal developers? If yes, you need to start thinking about how you make it easier for these external partners to adopt your APIs.

- Do I worry about how I am going to drive revenue from my APIs? If yes, you need to start tracking usage and linking that to business outcomes with a path to monetization, either directly or indirectly.

- Am I at risk because of the growing number of unmanaged APIs in my company? If yes, you need a way of automating discovery and securing API services across your company.

An API marketplace is not for every company. But it can help address some very real issues enterprises face when they start to shift their focus to API adoption, whether internally or externally.

What is the business case for an API marketplace? Watch the following video to learn more:

API marketplace examples: putting APIs to work

Just look at how multinational energy company Engie is leveraging APIs for smarter energy decisions and better customer experiences.

The group started by building a Common Data Hub on Axway’s Amplify API Management Platform: a master portal on which to publish documentation on all APIs across all business units and enable business users to register for access to their chosen APIs.

“Our Common Data Hub enables us to gather, store, and enrich the group’s data, which we then need to share as widely as possible. This challenge inspired us to become an API-First, data-driven enterprise,” said Gérard Guinamand, Chief Data Officer at ENGIE at the time.

With this foundation, Engie is using a marketplace as part of their business strategy:

“Amplify Enterprise Marketplace has the potential to be a game-changer for creating value with APIs and the developer experience,” says Grégory Wolowiec, Chief Technology Officer at ENGIE. “Once finalized, it will bring together a curated set of our API products from across our different business units – including multiple clouds, APIM vendors, and development teams – and clarify the business value of an API product especially by allowing various monetization models.”

In this clip from a demo of Amplify Enterprise Marketplace, Arun Dorairajan, Senior Solution Architect at Axway, shows how an API marketplace makes it easy to productize your APIs so they are all packaged and ready to go.

Watch the full Amplify Enterprise Marketplace demo.

One global pharmaceutical leader set out to more tightly align APIs with business capabilities, and with the help of Enterprise Marketplace is streamlining data access, accelerating clinical trials, growing e-commerce revenues, and more.

“By breaking out of the mindset of small, siloed API teams, we have totally reimagined the experience for both API producers and consumers,” says a company spokesperson.

Download our interactive eBook to discover what an API marketplace is, why you need one, and how it can drive value for your business.