Open Banking is gaining momentum—not because of regulations, but because consumers are demanding more control of their data and connected financial experiences. For banks and financial institutions, this creates both opportunity and pressure: deliver the seamless experiences customers expect, while protecting trust and security.

That’s where standards like the FDX API come in—helping institutions adopt secure, consent driven data sharing that unlocks innovation and positions them to compete in a rapidly changing landscape.

Given these needs, financial institutions need a secure, consumer-permission based standard. Here’s why the FDX API fits that bill, and why banks and credit unions should adopt it.

The Financial Data Exchange is leading the charge on data interoperability in North America

The Financial Data Exchange (FDX) is a consortium of key stakeholders in the financial data ecosystem tasked with creating a common API standard that provides interoperability around financial data sharing. When all the players in the ecosystem can speak the same language, friction can be eased.

API standardization is important in an endeavor like open banking, because without a common standard, each bank or credit union must develop custom APIs for every fintech it works with, creating a fragmented and costly landscape.

A lack of standardization also leads to vendor lock-in, where institutions become overly dependent on a single data aggregator, making them vulnerable to rising costs and reduced flexibility.

Many industries share some form of API standard, and FDX has become a critical part of financial data interoperability in North America.

Axway became a member of FDX in 2021, working alongside them to modernize the financial services ecosystem. As part of FDX, we’ve supported establishing common, open, shared standards for the exchange of financial data, leading the charge to bring open banking to North America.

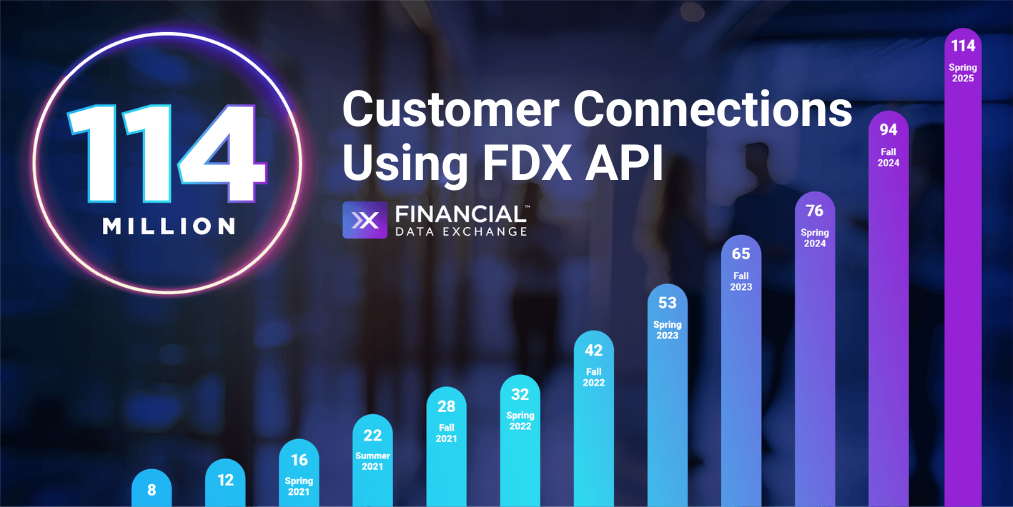

Today, the FDX API is leveraged in more 114 million customer accounts across the North American financial ecosystem.

The CFPB’s recognition of FDX as an official standard setting body is a nod to the widespread trust and acceptance of the standard, and a testament to the 230+ member organizations—which now include most major U.S. banks and fintechs—who believe in the FDX mission.

How the FDX API standard fulfills modern financial data requirements

Despite recent regulatory uncertainty — or perhaps as a result of it — collaborative industry groups will be more needed than ever, having already emerged as market-driven forces for cooperation and standardizing financial data APIs in the United States.

Here are five reasons FDX fits that bill:

- Security and trust – Consumers are concerned about how their data is shared and stored. The FDX API helps to replace outdated “screen scraping” methods with tokenized, permission-based access. This gives consumers and banks stronger control and traceability, reducing risk.

- Customer-centric experiences – Data shows that modern consumers expect seamless connection between their bank and the apps they use every day for budgeting, Buy Now Pay Later (BNPL), investments, and real-time peer-to-peer payments. Adopting the FDX API ensures that their customers get a consistent experience with reliable access to their financial data – without concern about who has access or how long they have it.

- Financial ecosystem participation – Fintechs, Aggregators, and other Financial Institutions are actively utilizing the Standard, lagging Banks are running the risk of being left behind.

- Operational efficiency – FDX Adoption reduces support burdens, cuts down fraud risk, and streamlines customer and partner onboarding. Time and money savings from this can help drive more innovation and better customer experiences.

- Regulatory alignment – With Dodd-Frank 1033 being re-evaluated and rewritten, the assumption is that regulation will come back. With FDX being previously named the first Standard Setting Body, aligning to the API Standard would position Banks ahead of future compliance requirements – and show their customers and regulators that they’re committed to safe, consumer-first data sharing.

The FDX API is no longer focused solely on compliance – it’s about building trust, enabling innovation, and staying competitive in this constantly shifting financial landscape.

Amplify Open Banking is an FDX-ready solution for securely delivering financial data

The latest FDX standards are always built into Amplify Open Banking—our solution for scaling and accelerating the exchange of data within the fintech ecosystem in a repeatable way.

By leveraging these common standards, we allow for seamless integration that makes it easy for financial institutions and third-party providers to collaborate, with security and transparency ensured.

See also: Dodd-Frank 1033: What the Final U.S. Open Banking Rule Means for Banks

Amplify Open Banking provides:

- Controlled access through ready-to-use FDX APIs that offer secure token-based authentication. FIs can provide explicit, limited-scope data sharing without revealing full login credentials.

- Granular consumer consent management so users understand and control what data is being shared, with whom, and for how long.

- Data protection through alignment with global standards – The FDX API Security Profile incorporates the Open ID Foundation’s Financial-grade API (FAPI) security standard, providing advanced protocols for:

- Securing API traffic

- Authenticating end users

- Implementing stringent security measures (FAPI 1.0 Advanced & CIBA protocols)

Amplify Open Banking delivers an intuitive developer experience that incorporates these standards natively. This makes it easier for financial institutions to manage and secure customer data access through robust security, identity, and consent management services.

Your fast track to Open Finance starts here

Our goal, like FDX, is to reduce the complexity around open banking APIs and encourage their adoption – offering a proven, rapid pathway to open banking implementation.

Banks that adopt these standards early set themselves up for a stronger Open Finance future. With Axway’s focus to “Open Everything”, our membership with FDX helps to enable a stronger open financial landscape.

The open banking revolution isn’t waiting. Are you ready to lead? Partner with us to help you build your open banking future.