The United States Consumer Financial Protection Bureau (CFPB) has just announced plans to rewrite Section 1033 of the Dodd-Frank Act, which was designed to give consumers the right to access and share their financial data and effectively mandate open banking in the U.S.

On May 23, 2025, the CFPB notified the court of its plans to revoke Section 1033, with the administration signaling intentions to write a completely new rule from scratch. On July 29th, the CFPB announced is requesting an accelerated process to address legal challenges and align with new leadership’s priorities, potentially pausing the ongoing lawsuit against the rule.

Axway remains committed to open banking as a strategy and will continue to adhere to the rigorous standards set by FDX. The regulatory landscape has shifted significantly since our February analysis, when the current administration first froze CFPB operations. Rule 1033 technically remains in effect until legally vacated, but uncertainty about the future of open banking regulation in the U.S. continues.

If anything, this reinforces our perspective that the fundamental business case for open banking is stronger than ever. Regardless of the ultimate regulatory framework, industry experts from around the world maintain that financial institutions have a unique opportunity to move beyond compliance-driven approaches and embrace open banking as a catalyst for innovation and growth.

Immediate and longer-term effects of the agency’s actions are becoming clearer. We recently had the opportunity to exchange with partners at the Financial Data Exchange (FDX) and FS Vector, a strategic financial services consulting firm, on the latest developments at the CFPB. Here’s what you need to know.

What’s happening at the CFPB?

Here is a summarized timeline of events and latest developments. Jump to the following sections for an understanding of the current landscape and what it means for you.

On Monday, January 27th, Scott Bessent was confirmed as Treasury Secretary.

On Saturday February 1st, the White House fired Rohit Chopra, then-director of the Consumer Financial Protection Bureau. At that point, Bessent was appointed as Acting Director of the CFPB and suspended the effective dates of all final rules that have been issued but are not yet effective. A small DOGE team was granted access to all the CFPB’s data systems.

Sunday, February 9th, employees were sent home for the week to work remotely unless otherwise instructed. CFPB operations were effectively at a standstill.

The following week, the Trump administration nominated former Federal Deposit Insurance Corp. Director Jonathan McKernan to lead the bureau. However, McKernan has since been reassigned to a different position at the Treasury Department, leaving the CFPB under the acting leadership of Office of Management and Budget (OMB) Director Russell Vought.

Mark Calabria, who previously served as director of the Federal Housing Finance Agency (FHFA), joined the OMB to assume an interim role at the CFPB. He has signaled in private meetings that he wants to start over from scratch on a new rule.

In late May the CFPB filed a motion in a lawsuit challenging the regulation to vacate Rule 1033, on grounds that it exceeds the agency’s statutory authority to create an open banking system. This represented a dramatic shift from defending the rule to actively seeking its elimination, and the Financial Technology Association (FTA) urged the Court to uphold the rule.

🔴 NEW: In late July, the CFPB announced it will rewrite Rule 1033 through an accelerated process to address legal challenges and align with new leadership’s priorities, potentially pausing the ongoing lawsuit against the rule.

So, where does this all leave us?

The facts about Rule 1033

Rule 1033, which requires U.S. financial firms such as banks and credit unions to give consumers access to their personal financial data at no charge, effectively mandating the use of open banking APIs, was announced in October of last year.

It took effect on January 17, 2025, but the regulatory landscape has fundamentally changed since then. The CFPB’s movements to vacate then rewrite the rule creates legal uncertainty about its continued enforceability and what is to come next.

What does this mean for standard-setting organizations such as FDX?

If anything, collaborative industry groups will be more needed than ever, having already emerged as market-driven forces for cooperation.

The Financial Data Exchange (FDX), for example, is not a governmental body. It is an independent consortium of key stakeholders in the financial data ecosystem, tasked with creating a common API standard for interoperability around financial data sharing.

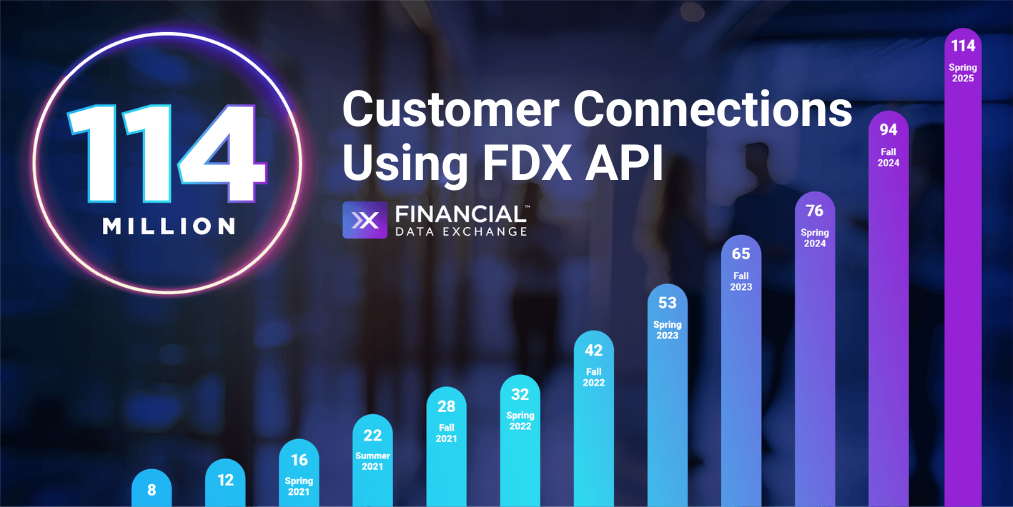

Despite regulatory uncertainty, FDX continues to demonstrate widespread trust and adoption in North America. The organization reports 50% growth in adoption over the past year, with the FDX standard now supporting over 114 million customer connections throughout the financial ecosystem.

FDX leadership has emphasized that amid a shifting regulatory environment, API adoption continues to move forward as more firms see benefits for their customers. At the same time,

“There’s still more work ahead. Tens of millions of consumers and small businesses in North America are still sharing financial data through methods that require sharing login credentials with third parties and may offer less customer control.

FDX remains committed to making it easier for companies of all sizes to build interoperable, secure integrations in the months ahead.”

The organization’s 230+ member organizations—including most major U.S. banks and fintechs—remain committed to the mission, investing in improving interoperability through working groups and member collaboration.

Open banking is already being embraced by the North American market because of the many benefits it offers banks and financial institutions. These include benefits like greater ease in engaging their ecosystem, better partner onboarding, stronger security and data consent management, enhanced protection against fraud and fishing… and of course, exciting innovation on the horizon.

What does this mean for my open banking strategy in 2025?

We have advised for years that, while regulatory compliance may be an initial driver for some, the business opportunity of open banking is by far the more interesting motor for transformation.

The current regulatory uncertainty actually reinforces this perspective. Organizations that have built their open banking strategies around genuine business value—rather than compliance alone—are better positioned to weather regulatory changes and continue driving innovation regardless of the ultimate regulatory framework.

While open banking requires banks to become an API provider, securely exposing their data for greater interoperability and competition, it also offers up a goldmine of actionable intelligence that, if leveraged, can yield rich cross-selling opportunities and beyond.

Open banking use cases that are of particular interest for retail banks and credit unions include:

- Account aggregation: use APIs to securely aggregate customer financial data across multiple institutions, enabling a more complete customer profile for cross-selling opportunities.

- Financial advisory services: get real-time access to client data, enabling wealth advisors to proactively offer high-quality, dynamic investment strategies based on behavioral insights and financial fluctuations.

- Real-time lending and customer interaction: eliminate long wait times for loans by aggregating transaction history and external data sources to offer instant prequalification and improved financial services.

Dive deeper into open banking use cases in this blog

At Axway, we’re proud to have played an early role alongside FDX in developing open banking standards in North America and shaping business models for the future. We help banks and credit unions deliver these types of innovative services to an expanded consumer base faster, by combining an intuitive developer experience with secure data management.

Amplify Open Banking makes it possible to leverage open banking APIs for secure data sharing, improved customer trust, streamlined third-party collaboration, and new revenue streams through API monetization.

Don’t hesitate to seize the open banking opportunity

Headlines may focus on regulatory uncertainty, but successful institutions recognize that open banking transcends compliance requirements. It’s a business imperative driven by market demands and customer expectations.

It may take a more adaptive approach than originally anticipated, but staying the course with open banking implementation plans is a wise path: continue advancing your open banking capabilities while building in flexibility to adapt to eventual regulatory changes—whether that’s a revised rule, a completely new framework, or a more market-driven approach.

This is a good time to get your internal API house in order – not just to prepare for the possibility of regulatory evolution, but to better unlock the value of your core systems. Given the uncertainty around future regulatory roles for standards bodies, the FDX’s continued growth and industry support becomes even more valuable as a market-driven mechanism for coordination. Engaging with FDX, continuing to build strong partner ecosystems, and investing in robust API infrastructure will help FSIs develop a clear value proposition around their open banking program.

As a leader in core enterprise integration solutions for more than 20 years, Axway helps companies shape and implement sound strategies for success in a shifting digital business landscape. Our Amplify Open Banking solution gives enterprises the tools to accelerate their open banking strategy and rise to the evolving challenges of ecosystem participation, consumer trust, and operational efficiency.

Forward-thinking financial institutions have an opportunity to shape the future of banking through open banking initiatives. Success will come to those who view open banking not as a compliance exercise but as a strategic imperative for growth and innovation.