We’ve known for a while that open banking has the power to transform the way we handle our money – from enabling faster, more convenient payment solutions to democratizing finance. But recently, there’s been an uptick in green fintechs using sustainable open banking APIs to create solutions that directly address the impacts of technology on the climate, the need for environmentally-friendly solutions, and a move to a circular economy.

Speakers at a recent webinar describe how Europe is trending in the adoption of open banking for sustainability, discuss which APIs can help embrace the green transition, and offer best practices for using the Axway Amplify API management platform to empower open initiatives across the financial services industry.

The green fintech market in Europe is blossoming

Mark Boyd, founder of Platformable and author of the Open Banking APIs State of the Market Report 2022, has been researching the impacts of climate on city governments since 2008. The lead author of the European Commission’s API Framework for Digital Governments, he has long seen the potential to use APIs to address climate change.

A growing number of companies are building financial products and APIs that are designed to support sustainability: 8% of all European and UK fintechs using Open Banking APIs have a sustainability product (or “green fintech”), and most of these are Digital Payment and Account Solutions.

Boyd highlights a few examples:

Meniga offers a white-label carbon calculator tool for banks, so their customers can measure their carbon footprints and take sustainable action. It even categorizes spending by carbon footprint, such as transport, travel, or food.

Boyd notes that the banking payments and banking account APIs, available in Europe under PSD2, are what make these sorts of products possible.

NLB Agro is a financing solution for farmers that helps modernize equipment, increase productivity, and reduce the effects of climate change. It offers tailored financing and flexible credit, combined with individualized counseling and advisory services. Cashless payment gateways allow farmers to support their sales processes.

Tumelo enables investors and pension holders to have a say in how their money is invested to create and benefit from a more sustainable investment system. The platform allows shareholders to vote on sustainability related investment decisions, and pension fund holders can request in the app to move pensions to sustainable options. A Transparency API helps investors see the company holdings inside their investment portfolios to ensure they are sustainably investing.

Finally, KBC was a first mover in creating API products that drive sustainability actions. For example, it offers APIs and widgets for bicycle retailers and merchants and credit intermediaries, allowing the company to gain new validated loan customers at lower customer acquisition cost.

Where open banking APIs can have the greatest environmental impact

Banks can have a great influence over what sort of products are built, Boyd says, noting that PSD2 Accounts and Payments APIs have enabled the greatest category growth in Green Digital Payment and Account Solutions.

The majority of greenhouse gases come from four high-impact sectors: Energy use in industry, transport, energy use in buildings, and agriculture and land use. But Boyd points out that the majority of what’s been built is targeting individuals in households, and only about 30% overall, whether that be enterprises or individuals, is actually focused on one of those four areas.

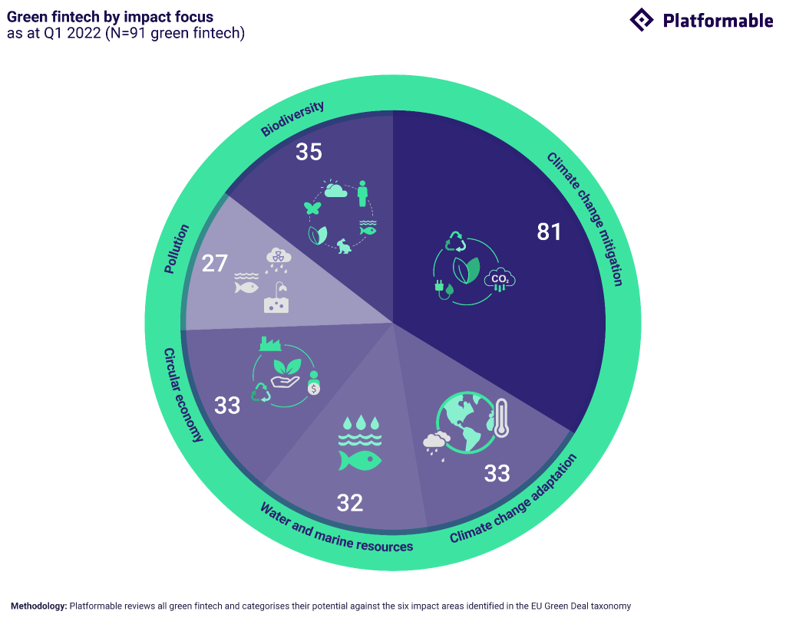

“There is some work to do to move alignment towards where there is going be an impact on improving sustainability. When we look at the market overall, the majority of products are addressing climate change mitigation and some climate adaptation, but fewer products are focusing on other sustainability goals like biodiversity and the circular economy,” Boyd says.

The market is just getting started, and Boyd concludes there’s a need for more use cases and more product ideation – especially ones that move from simply building awareness to creating opportunities for sustainable action.

Actions that contribute to sustainability include in-app product switching (i.e. updating a vehicle lease to an electric vehicle or buying refurbished goods instead of new) and in-app supplier switching (i.e. swapping an energy provider to a more sustainable provider or shopping for a more sustainable investment portfolio).

You can download Platformable’s Open Sustainability Trends Report to dive into the potential of open banking and open finance for sustainability solutions and see where opportunities are emerging.

Following the customer’s needs: Commerzbank’s open banking journey

A leading international commercial bank, Germany’s Commerzbank serves more than 18.8 million private and small business customers, as well as more than 70,000 corporate clients, multinationals, financial service providers, and institutional clients.

Beyond that, Commerzbank was developing sustainability strategies as far back as the 1980s and is currently committed to becoming a “net zero” bank: trying to reach a neutral asset portfolio within the next several years. The bank’s strategy is very much focused on digitalization, with major IT investments for digital transformation over the next two years, in order to accomplish these goals.

Heiko Dosch, Business Expert of API Strategy, Open Banking, and Digital Ecosystems at Commerzbank says it’s really their customers that prompted the drive toward open banking.

“Today, banking is necessary, but banks aren’t!” Dosch says. “Our customers demand the state-of-the-art user experience they are used to from other industries, like with Amazon and other big tech players, but with a bank’s data security standards.”

Between new players vying for a piece of the banking pie and new regulatory requirements such as PSD2, Dosch says banks need to react in order to stay relevant.

And that’s what Commerzbank is doing.

It started with a wakeup call, says Volker Sulzbach, Subject Matter Expert in API & EAI Technologies at Commerzbank. In 2016, an executive showed the team a video clip from a very well-known eCommerce player that wanted to expand into banking territory, and it brought into sharp focus just how easy it was to make banks redundant.

The team also saw the opportunity of open banking:

“With this market pressure on the one side, but also the inspiration we took from that video snippet, our conclusion was that we had to start our own API program – one that exceeds by far the minimum requirements that came with PSD2,” Sulzbach explains.

Going API-First to accelerate banking services

Looking beyond PSD2 compliance to realize the business promise was an important step in Commerzbank’s open banking journey.

In 2017, after searching for a solution that fulfilled both excellent API and catalogue management with a strong focus on high security standards, Commerzbank selected Axway’s Amplify API management platform to build up its infrastructure as a technical foundation to leverage APIs.

But the transformation wasn’t just technical: it also required a cultural shift.

“We had to deal with replacing our accustomed way of web service development with the fairly new API-first thinking, and the API design guidelines Axway’s experts brought up. But the more the whole organization understood the benefits of APIs, the faster we were able to produce and deliver quantity and quality,” says Sulzbach.

With that secure foundation to expose APIs, companies can focus on agility, says Eric Horesnyi, SVP, API Platform EMEA at Axway.

“You can reuse assets internally; you can innovate faster and actually minimize the carbon footprint of your IT, and you get better at quickly integrating new services for your ecosystem,” explains Horesnyi.

In part two of this series, you’ll find out how Commerzbank not only leveraged its APIs to drive revenue and expand its ecosystem, but is also offering greener services to fulfill the bank’s environmental responsibility goals.

Plus, Eric Horesnyi describes other green API use cases, and how Axway has the opportunity for impact as an API leader, helping companies reuse their assets in order to maximize the circular economy that APIs make possible.

Discover keys to successful adoption of APIs in financial services.