UPDATED 11/14/18

According to the 2017 International Air Transport Association (IATA) figures, commercial airlines posted their strongest financial performance ever in 2016—reporting $35.6 billion in net profit, just a bit above 2015 results but nearly double those of 2014. For the third consecutive year (and only the third year in airline industry history), carriers reported a positive return on invested capital. Even Warren Buffet has recently invested billions of dollars in Airline companies.

These record results are mainly due to a drop in oil prices which usually account for 33% of costs. After average petroleum prices hovered around €80 per barrel between 2011 and 2014, the 2016 average of less than €42 helped boost profits, meaning the aviation industry spent under 20% of total costs on fuel for the first time in over a decade.

Results

Good results do not wipe out the challenges that airline companies still have to face such as security, environmental impacts, political unrest, and oil price increase. Oil prices are increasing, and global traffic growth was expected to slow in 2017, according to the IATA. A slowdown that is particularly likely if GDP growth remains sluggish. Both trends would make it harder for the industry to maintain recent high levels of profit per passenger. Add to this the drop in airfares due to severe competition and higher consumer expectations.

According to PWC, to capture top-line growth in this competitive environment, airlines need to incorporate the best of what the so-called channel consolidators do and offer holistic and attractive travel distribution programs. They need to ensure that their direct distribution channels (primarily websites and phone banks) and loyalty programs can deliver personalized service and offers to business and leisure customers. Simply put, airlines must combat ticket commoditization by developing, alone, or in partnership with global distribution systems, enhanced merchandising applications that will allow them to cross-sell and upsell using their privileged access to millions of global travelers.

Digital capabilities

Carriers cannot afford to focus solely on ticket sales, leaving other companies to pick up the ancillary revenue—including lodging, rental cars, entertainment, and personalized itineraries—that surrounds the flight. To do so, airlines will have to build digital capabilities, integrating customer data they collect into a complete view of the traveler, transforming the insights yielded by this data into compelling, personalized offers, and constructing an interface and apps that make them stand out in a crowded market.

The airline industry will have to manage the integration of information across all channels and change the mindset of protecting their data at all costs. IATA’s New Distribution Capability (NDC) is an effort to remedy this problem by offering a new XML-based messaging standard to give travel agents richer content via GDS. This will enable the airlines to make customized offers via travel agents and help bridge the gap between the commoditized information currently available to the agents and the full content available on the airlines’ websites.

The passenger expectation is to be constantly connected, well informed, and in control of their journey. IATA NDC provides a framework on which to share the crucial data among all those involved in the passenger’s travel.

Moving towards customer experience networks

CX networks represent a key enterprise and technological movement in which omnichannel plays just a small part. According to IDC and Axway, a customer experience network enables an organization to connect and embrace co-innovation from all entities a customer may encounter along the purchasing journey. Customers, employees, business partners, and suppliers collaborate and co-innovate to deliver improved, more holistic shopping experiences.

CX is essential

CX networks are a mechanism for creating new innovative revenue streams. As the world enters a new era of the connected economy, CX networks will be essential to establishing a sustainable competitive advantage, increasing business value, and defending against digital disruptors.

So it’s no wonder that CX networks have taken their place at the top of board-level agendas as large enterprises aim for higher brand value and strategic differentiation. Many airlines have invested their time and capital into establishing omnichannel communication and data connectivity, as they should. But few have taken it to the next step: CX networks. What could they be waiting for? Perhaps it starts with a basic understanding of the three foundational elements that propel CX networks beyond omnichannel.

- CX networks embrace all internal and external enterprise stakeholders in an “Omni” kind of way—but in a much more strategic, holistic, meaningful, and coherent way than simply omnichannel communications.

- CX networks enable enterprises to develop an ecosystem of internal staff, external business partners, customers, and other stakeholders to provide communication, collaboration, and co-innovation aligned to a central business purpose.

- The synergistic value created by CX networks is greater than the sum of its parts. It will provide you with the means to crack the code to deliver superior customer experiences.

Airlines and the “broader travel ecosystem”

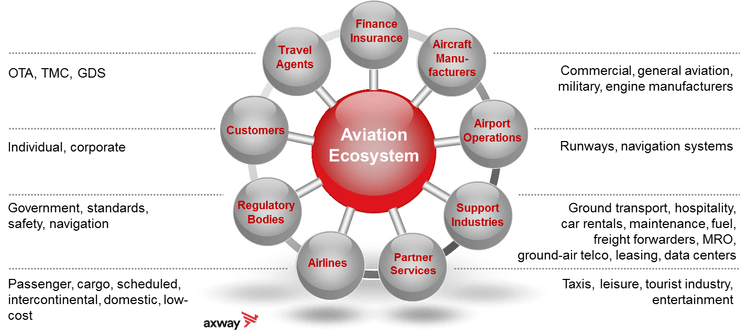

The idea of airlines living in data silos is outdated. Through a combination of the internet and other technology, airlines form part of a broader ecosystem. Think of the parties involved to deliver goods ordered from Amazon, for instance. Airlines are no different: today’s customers use the Internet, social media, and in-airport technology for every flight.

API’s and a CX Network play a central role in building these ecosystems. Airlines, like every other industry, should leverage their APIs and encourage developers to create new ways to make the customer experience more convenient and enjoyable. Collaboration is the key to innovation today, and airlines shouldn’t be missing out.

Implementing a CX network

Establishing a CX network is largely about creating a community. Its success will reside in how fast you can achieve a critical mass of interactions with your ecosystem organizations. From a technical standpoint, you will need an integration platform with at least the following capabilities:

- An API Management layer that allows you to publish your service interfaces, including via NDC, and make them accessible to all ecosystem members while enforcing data security, user authentication, and confidentiality of information

- A mobile application development framework that accelerates time-to-market of mobile app development

- Analytics technology that allows you to measure usage and performance, have visibility into supply chain processes, and obtain predictions on future customer behavior and trends

- Integration technology, including EDI, MFT, and API that allows you to exchange business documents with partners and integrate network members’ data

- A member directory tool that automates member onboarding and lifecycle, and keeps up-to-date business details as well as technical details for automated business interactions

Learn more about Customer Experience Networks here.