Open banking API providers all have the same goal: to transform the way we bank for the better. They all just have their own unique way of getting there.

Open banking is starting to gain wider recognition in recent years, even among general consumers, as more banks turn to open banking to improve customer experiences. A wave of regulatory activity across North America is also sure to accelerate adoption of open banking in the months and years to come.

The evolution of open banking

As an Accenture report notes, these waves will take place at different times around the world — but growth is expected to take off fast. And the time frame for takeoff isn’t too far in the distance. Research indicates that 76% of banks worldwide expect open banking API use and customer adoption to increase by at least 50% over the next three to five years.

In a recent webinar, Axway Catalyst and moderator Chris Wood was joined by three experts in the field — Mark Boyd of Platformable, Giulio Rattone of Fabrick, and Axway’s own Liad Bokovsky — to discuss how banks are evolving into API providers within the open banking framework. We’ve compiled some key takeaways from their conversation while offering further context around the industry dynamics and what’s next for open banking.

The biggest questions surrounding open banking

As the founder of Platformable, Mark Boyd is the author of the Open Banking APIs State of the Market Report 2022 and has extensive experience in measuring the value of ecosystems.

It’s clear that even since 2021, open banking has progressed. The question is how to create open banking that goes beyond adhering to regulatory requirements and adds value to stakeholders. To compete in this ecosystem, banks need to navigate challenges related to COVID-19, market issues, and the increasing volume of banks, including tech giants, fintechs, and neo-banks.

Much of Europe and the U.K. have adopted open banking and implemented APIs that enable payments and account integrations. While the practice of open banking may have started to facilitate competition with the financial services industry, it has ultimately created a new data-sharing infrastructure that makes financial information more accessible to customers and makes it easier for them to control and manage.

Currently, Norway and Denmark are pushing ahead regarding the number of available open banking platforms. Backed by a regulatory-driven framework, there is a mandate in these and other European countries to share data, which encourages development of API solutions.

Who benefits from open banking investments?

Boyd’s research states that seven stakeholders benefit from open banking systems.

Banks, as one example, can expand beyond their traditional business model and offer a new distribution channel that helps to deepen and improve their customer relationships.

Fintechs, meanwhile, can provide alternative systems that deliver a convenient digital experience while minimizing costs associated with accessing consumer data.

Then there are consumers and individuals who benefit from new digital services through the opening up of access to their bank accounts via their favorite apps and products. This combination delivers greater convenience and speed.

Enablers are also part of this vibrant open banking ecosystem, giving their customers the necessary technologies to improve their banking experience and grow their business.

Society can benefit from these digital systems as well. For example, one of the use cases of open banking is tax automation. With taxes more embedded into the everyday lives of consumers, businesses and individuals have the means to make more informed decisions about their finances, while tax collectors will receive more of their requested funds.

In the U.K. alone, tax collectors lose approximately $45 billion annually due to tax non-payment, avoidance, and fraud. The visibility of transactions for taxation purposes paired with an improved user experience make it easier to complete the tax process.

To circle the conversation back to banks, these institutions benefit from over 379 API platforms in Europe alone, along with open APIs. In the case of payments and accounts, technologies must be made available via premium APIs.

We can look to PermataBank as one example of how these benefits take shape, with the bank increasing their new accounts by 375% percent over four years. DBS Property Marketplace — an online property marketplace product from DBS Bank — has generated more than $220 million in home loan requests within a 12-month period.

A closer look at fintechs

Fintechs in particular benefit from the means to innovate in the field of payments and accounts integration. This can be accomplished through four development models:

- Open platforms, released as part of PSD2

- Partnership platforms

- Incubators and acquisitions

- Banking-as-a-service (unbundling banking services)

The value for fintechs lies in using open banking APIs to monetize the openness of data, overcome service competition, and develop smart solutions that serve both the needs of businesses and customers alike.

Businesses can use big data to provide consumers with a more personalized experience that meets their expectations, while customers can enjoy the convenience of making purchases from their current mobile or web environment — no extra steps needed.

Platformable’s report highlights that building a more flexible banking infrastructure is central to enabling a digital mindset.

Learn more by reading the latest trends report.

How open banking API providers are evolving

Fabrick is a provider of open banking solutions that operates in Italy and is expanding into other European markets. Giulio Rattone, CIO of Fabrick, explains that their ecosystem enables new business models that help banks, insurance providers, and businesses meet evolving user needs.

Since 2013, Europe has been at the epicenter of open banking when PSD2 (Payment Services Directive) came into fruition at the European Commission. This framework for regulatory-driven electronic payments and services was designed to modernize banking efforts in a safe, secure manner and better serve consumer needs. In its simplest terms, PSD2 is a regulatory-driven effort to foster industry innovation and protect customers.

By 2016, open banking standards were published in the U.K. Under the directive of U.K.’s Competition and Markets Authority (CMA), the nine largest U.K banks were required to let licensed startups directly access their data through open APIs, working alongside the more general PSD2 regulations relevant to all payment account providers.

By September 2019, PSD2 open banking was initiated throughout Europe.

Since becoming a regulatory requirement in the U.K., open banking has experienced exponential growth. Seven million people in the U.K. used open-banking enabled products in 2022, and 1.2 million of these users were doing so for the first time.

See also: 5 years in the making: UK Open Banking finally gains momentum

The three phases of open banking in Europe

1. Reactive

The reactive period of open banking lasts from 0 to 12 months. One of the key factors behind this time to get up and running is the cost of the API. Building even a relatively simple API that is secure, documented, and fully featured can cost an average of $20,000. Payment service providers (PSPs) expose mandatory interfaces, and some plan to monetize this by providing data beyond the PSD2 perimeter.

2. Proactive

The proactive period of open banking falls in the window of 12 to 36 months. At this stage, bank connection coverage and service quality are key priorities. Some PSPs are starting to play a more active role in this process, enriching payment interfaces with services such as account aggregation alongside digital and multi-banking solutions for corporate and small- and medium-sized enterprises.

3. Added Value

The added value period of open banking typically happens somewhere around 36 to 72 months. Big data and AI factor into these efforts. For instance, AI-based tools can analyze API dataflows to categorize and assess the quality of leads, predict the future purchase behaviors of customers, and appropriately target them with effective sales and marketing campaigns. Some PSPs create an open banking-oriented strategy.

Open banking is not just limited to the financial services industry — it’s a system that can also be leveraged across other industries, too. For example, utility companies can use customer account information to identify and manage customers at risk of defaulting on payments and then work to provide a solution. Meanwhile, retailers can use rich data around consumer spending patterns to deliver point-of-sale offers and discounts that resonate with consumers.

The platform model of open banking evolves the financial offer by using ecosystems. The value chain is open, modular, and data-driven. The bottom line: open banking is about offering products and capabilities to other banks’ customers.

Believe the open banking hype

Liad Bokovsky, Axway Innovation & APIs Expert, asks this question: “Where are you on the open banking Hype Cycle?”

The Hype Cycle, as you may know, is Gartner’s methodology for assessing the maturity of emerging technologies through five lifecycle phases:

- Innovation Trigger

- Peak of Inflated Expectations

- Trough of Disillusionment

- Slope of Enlightenment

- Plateau of Productivity

The goal of the Hype Cycle methodology is to help businesses understand how a technology will evolve over time and provide insights not only into its relevance and role in the marketplace but also how to manage its deployment to align with business goals. In relation to open banking, the Hype Cycle helps CIOs evaluate the capabilities needed to enable this new system.

It’s clear that open banking is a growing sector. The key question is what is driving this growth. Standards like PSD2 are a critical component in developing an open banking strategy for data.

Open banking API providers have the same goal

Initiating changes and exposure takes time. When open banking is introduced in banks, the back end of a bank’s operations can remain the same while an API works to enable third-party connections.

Below the surface, market-driven regions design a stack that can quickly compete, yet they lack the ecosystems to measure up. This speaks to the importance of adaptability. Traditionally, banks are horizontal, and implementing these ecosystems is difficult, which causes them to fall behind in the innovation curb.

Today, fintechs are applying pressure to bigger banks to innovate to stay relevant in the market. And open banking is one of those differentiators that’s setting banks apart.

As the so-called gatekeepers of financial data, banks are positioned to advance their digital initiatives and develop fintech partnerships that add value to consumers and businesses alike.

If banks fail to embrace this innovation, they risk falling behind while limiting their potential to connect with clients through digital touchpoints that can lead to greater customer satisfaction and new revenue streams.

In contrast to the U.K. and Europe, North America has not had the same regulations that force banks to open up their data in a universal format – until now. Recent moves from the U.S. and Canadian governments aim to standardize how the financial ecosystem shares data based on consumer consent. Expect more developments to come in 2023 on this front.

Within a market-driven framework, it can take longer for the negotiations between third-party providers and banks to be reached, with variance in the degree of provided data.

An open approach without a common language can be challenging, and one organization is taking on the creation and use of a common standard in North America: The Financial Data Exchange (FDX).

FDX is a consortium of key stakeholders in the financial data ecosystem that is tasked with creating a common API standard that provides interoperability around financial data sharing. At last count, the FDX reported 42 million consumer accounts using its FDX API.

Expanding beyond compliance

Going beyond mere regulatory compliance, banks found they could not only expand their offering, but also begin to compete in this new marketplace.

Banks realized they didn’t need to just be providers of data, they could also consume it. Some started leveraging the data from other financial institutions and aggregating it in order to offer new payments and account information services.

Finally, some banks began to transform their business model, evolving to offering services as a platform and becoming an enabler for other third-party providers.

Four powers of APIs to drive open platforms

APIs play a powerful role in open banking – and beyond that, in the digital transformation of a business — which helps to explain their anticipated surge in growth. In a 2021 RapidAPI survey, 58% of executives reported that participation in the API economy was one of their top priorities. That figure was even higher for the financial services sector, rounding out at 62%.

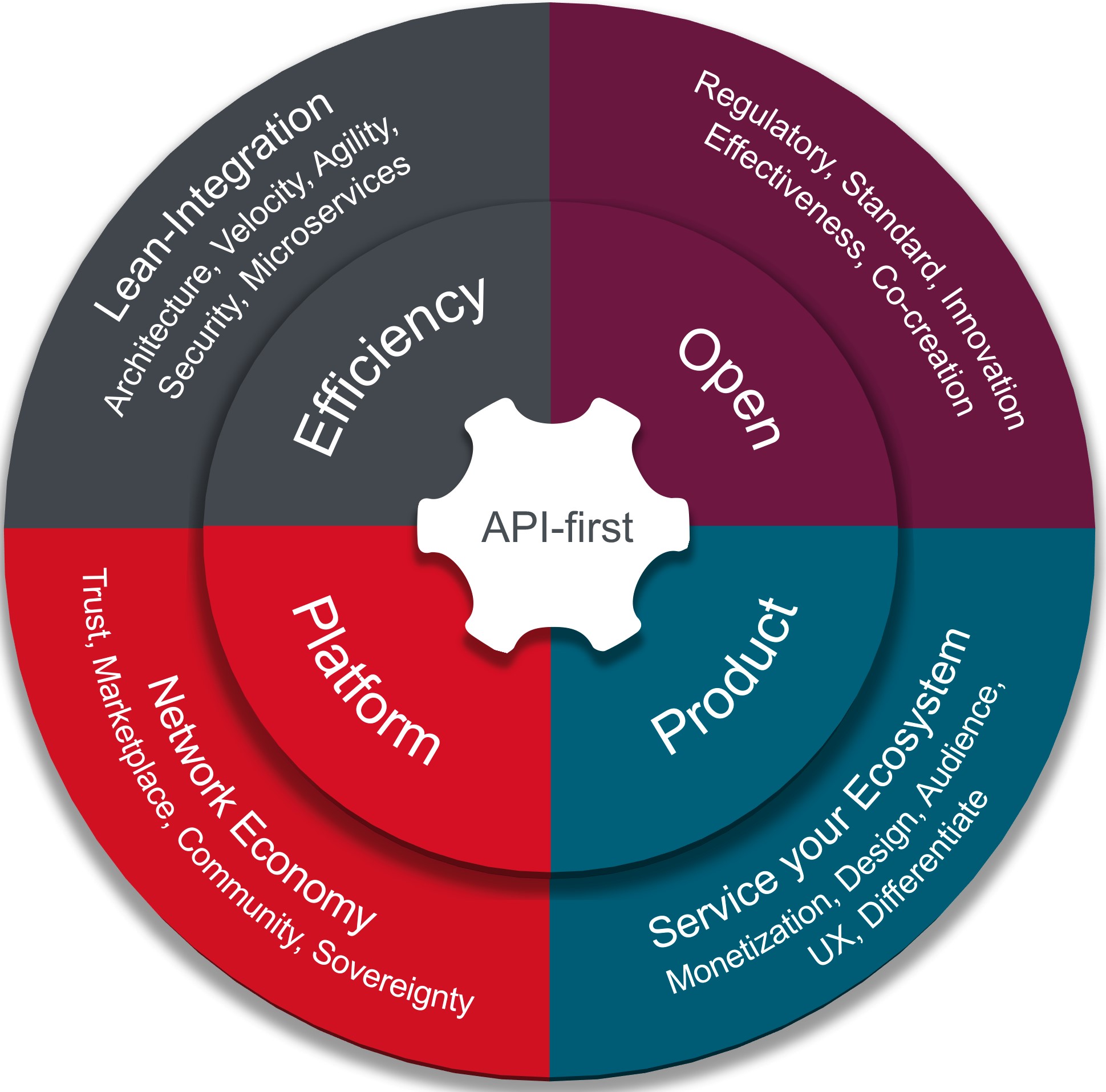

When it comes to what makes APIs so powerful, there are four factors to consider.

- Efficiency

APIs modernize an organization’s information systems via architectural optimization. Customer data is supplied in an encrypted format in the most efficient way possible.

- Openness

Involving more teams in API development offers opportunities to modernize operations. Businesses can further enrich their information systems and target external partners.

- Product

APIs take on the vision of a new distribution channel that can be integrated into a larger ecosystem. From online payment tools to geolocation tools, core data is consumed via third-party applications.

- Platform

Businesses with APIs begin to see themselves as intermediaries of connections versus just a service provider or consumer. Trust, security, ease of use, and billing are essential assets to enable meaningful connections.

Take a look at the circle chart below. It lays out how an API-first approach uses the four powers to work together to spur change.

The evolution to embracing a network economy is a major driver for banks and financial institutions in implementing an API marketplace. Beyond development and management with an API portal, an API marketplace offers the tools to treat these digital interfaces as products.

When based on a universal API platform, a marketplace can support a bank’s digital business strategy. It offers centralized governance and security for APIs and the financial services and products derived from them. This return can only be achieved if the company is aligned and committed, led by a business strategy that targets specific use cases and markets.

The value of APIs in the banking sector

In today’s economy, banks need to be an API-first organization. Beyond technical tools, banks see opportunities to monetize APIs via collaboration and third-party integrations.

Consider CitiBank as an example. By launching a global API developer hub, CitiBank made it easier to rapidly connect with fintech companies and consumer brands and give them access to financial solutions. One of these API-fueled partnerships is with the e-commerce platform HKTVmall. When purchasing at check-out, customers can conveniently use their Citi reward points – without leaving the digital platform.

At Axway, seamless integrations like these begin with our Amplify Platform, which securely opens up data through an open approach to universal API management. Built on this foundation, Amplify Enterprise Marketplace helps make those APIs consumable so they can serve a financial institution’s business objectives in a more focused way.

By building their own API marketplace, financial institutions benefit from:

- A single consumer entry point for both internal and external consumers

- Customizable, automated consumer and partner onboarding

- A product foundry where you can assemble new product offerings from assets and provide documentation pricing plans.

Because it is data-plane agnostic, a marketplace built on Amplify can connect to any gateway or event hub and handles broad integration assets and APIs (REST, events, files…).

This allows banks to not just manage the API lifecycle, but also and measure the value of their API integration assets. Marketplace gives organizations the tools to measure adoption and value KPIs like direct revenue traffic, processes optimized, speed of development, or business area adoption and number of third-party partners.

Creating new revenue opportunities with open banking

APIs are a big investment for businesses, but they come with a large pay-off when organizations drive their consumption. By using APIs to create platforms and ecosystems and facilitate new developer relationships, banks can generate new revenue opportunities for the future.

An early API adopter in North America, CitiBank has already seen these benefits play out. Since its 2017 launch, CitiConnect® API has processed more than one billion API calls. These volumes saw a 60% increase amid the pandemic, helping clients enable operational efficiency in the face of changing workplace dynamics. With more employees working remote and an increase in physical distance, the value of data interoperability and collaborative technology has increased.

Research from Accenture further supports these investments. Banks that embrace open banking initiatives can expect a potential revenue increase of up to 20%. And as the bar is raised, those banks that don’t adopt an open banking strategy are at risk of losing out on 30% of their revenue to the competition.

In other words, don’t wait to seize the open banking opportunity. Our purpose at Axway is to renew and innovate our customers’ capabilities to drive their success with an “Open Everything” mentality – and that’s how we help turn the technology into real business results.

Discover keys to successful adoption of APIs in financial services.