The RPA market is booming, automation is catching up to the white collars, creating turmoil within the accounting department.

Recently, Gartner stated that “the RPA market grew 63.1% to $846 million in 2018 making it the fastest-growing segment of the enterprise software market.”¹ Even if the total value of this segment is “only” $846.2 million, which is small related to others segments such as API Management, for example, the growth is to be acknowledged as it clearly represents a trend of adoption by large enterprises.

RPA in short

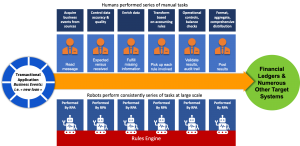

Robotic Process Automation is not to be confused with Business Process Management—even if several providers of RPA tools are found to be BPM vendors. The target of RPA is quite different, the point is to cut down the process in basic tasks. Further, if possible, create as many robots as there are automatable tasks.

If we take the following example provided by KPMG.

Three tasks from four are automated by three robots.

Of course, this approach is very pragmatic, as most of the time the point is to automate repetitive and well-defined tasks that are generally done by someone having a Bachelor’s or a Master’s degree who is overpaid for the job and is frustrated by his job. The benefits it brings include quality increase, reduction of time window needed, costs reduction ability to recover the wasted quantity of brain to address new business and organizational challenges.

How does it work?

RPA is mostly leveraging old concepts of Expert System and AI using a rule engine that execute rules describing the task. In short: If “this” do “that.” A rule engine dynamically applies the appropriate rule to an event based on the context of the event. It solves the difficulty of having countless combinations of “this” and “that.”

Is this new?

Of course not! Rule engines exist for decades and have been designed to apply rules to something. Let’s look at an example close by the one pointed above, such as the “accounting integration process.” We can see that this process is cut down into tasks that can each be automated through rules. The beauty of this example is that there is only one engine used and all tasks are consistently executed, the main benefit of this is that the process is generating a complete and actionable audit trail.

At Axway, we have 250 very large customers running this kind of architecture to run their accounting integration process. Each of them having millions of business events a day to push into one or several General Ledger.

What is the alternative?

Still, for most enterprises, the current alternatives are based on spreadsheets using complex formulas, handling millions of records through macros and being ultimately complicated to maintain and to integrate within back-office processes and definitely not scalable.

Moreover, this kind of “automation” is not auditable. A recent PWC survey of French CFOs reported that process optimization related to the Record-to-Report process is the one being used the most except by CFOs within particular 46% of large enterprises looking for Robotic of Transactions. The same survey states that 79% of CFOs are looking to digitalize and automate processes.

AI Suite, RPA for decades

On the other side, some of them did not invest in automating simple tasks but rather on automating a complete process using a Rules Engine dedicated to accounting: Axway AI Suite. The benefits are the speed of deployment, quick ROI, scalability and auditability.

For example, Carrefour in France is using Axway AI Suite to automate accounting integration for very large volumes (fifty million events a day) among the benefits they got from such a transformation, they are particularly acknowledging “today our business people focus on analyzing data and less time on looking for a problem, before (…) there was a full time person in accounting organization just there to look and check for errors.” Another example is BNP Paribas that is processing, with Axway AI Suite, tens of millions of events every day.

Learn more about Axway & Unit4 team up for digital insurance with AI Suite.

¹Gartner, Market Share Analysis: Robotic Process Automation, Worldwide, 2018, Fabrizio Biscotti, Cathy Tornbohm, Bindi Bhullar, Derek Miers, 23 May 2019