Finance departments are at the heart of companies’ digital transformation. To support this evolution, they must take on new roles and carry out new missions. With Axway Financial Accounting Hub, we’re proud to offer a solution that addresses the challenges of operational excellence, agility, and trust at the heart of these expectations.

(Lire cet article en français ici.)

Transformation and improvement, major challenges for the finance department

The digital transformation of companies has significantly changed the role of CFOs. While finance departments have mastered their operational and financial responsibilities – such as ensuring the accuracy of accounts and compliance with regulatory requirements – they are also being entrusted with new missions.

In lockstep with the company’s various businesses, they no longer account merely for the past, but also react in real time to current events and anticipate the future by providing the information needed to make quick, data-driven decisions.

Finance departments are seeking to improve three major areas:

- Optimize their operational efficiency to reduce operating costs while accelerating the processes and the quality of the data provided

- Continuously improve their agility to respond to all the changes inherent in the life of the company: regulations, new business units, mergers & acquisitions, creation of a new subsidiary, etc.

- Expose relevant, quality data to each business unit, according to their expectations, for better decision making.

Axway Financial Accounting Hub, a future-ready business platform

As a long-standing partner of finance departments, Axway has demonstrated its ability to anticipate trends and innovate with concrete solutions.

“Analysts and major consulting firms agree that today’s finance information systems need to embrace new capabilities and include a Financial Accounting Hub, not just an accounting rule engine,” says Lionel Linossier, General Manager of Digital Finance at Axway. “Alongside the business lines, finance departments want to provide real-time information from the vast amount of data at its disposal to improve management and strategic decision making.

“We designed (AFAH) to be the meeting point between finance and business, based notably on our expertise in APIs. With its richness, flexibility, and scalability, AFAH marks a major evolution and a complete response to the expectations of finance departments.”

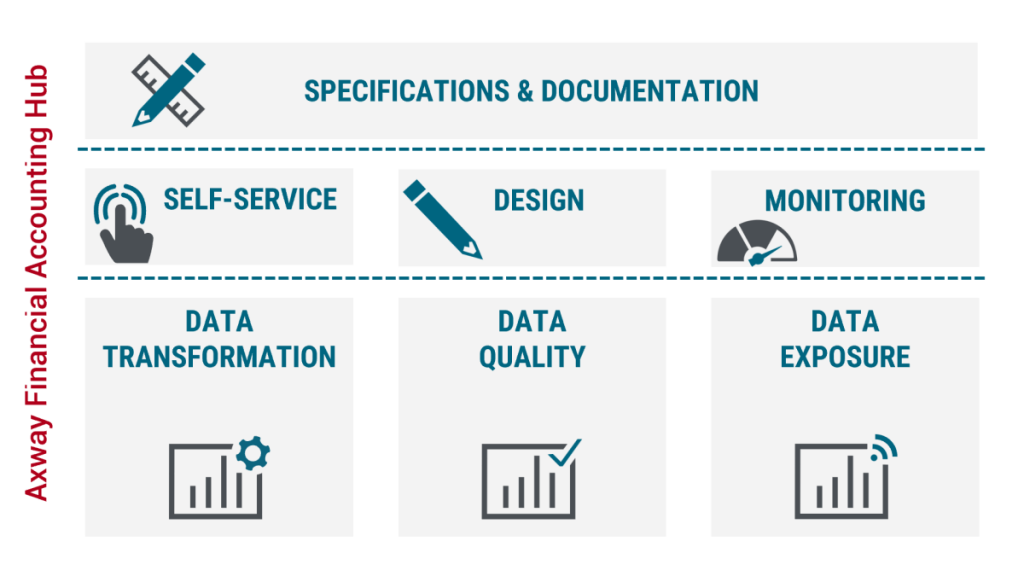

Axway Financial Accounting Hub is built around three main services: data transformation, data quality, and data exposure. Key innovations include contributions to:

Operational excellence

Axway has been automating large-scale accounting chains for over 25 years to improve the performance of finance departments.

- Being able to define accounting schemas in the form of decision tables accelerates their automation and simplifies their maintenance.

- A single design environment prevents redundancy and simplifies the management of different objects: rules, tables, data sources and repositories, forms, reconciliation operations.

- Empowering financial actors to test their own configurations enables faster cycles.

- The evolution of the technical architecture and the use of APIs allow for real-time processing, guaranteeing fewer costs and delays as well as improved compliance.

“Axway Financial Accounting Hub allows us to support the business lines on a daily basis. We can launch a new product very quickly, as it only takes two to four weeks to make the necessary accounting adjustments,” says Gharib Chahr, Head of Project Finance and Accounting Control at ODDO BHF.

Increased agility

Finance departments are undergoing a major transformation and require a highly flexible platform to build a composable finance information system designed to meet regulatory, business, and technology requirements. The Axway Financial Accounting Hub platform:

- Is independent of existing and future applications as well as accounting standards and norms; can be deployed in the cloud or on-premises with full reversibility; is based on a connector architecture; enables the information system to respond quickly to changes and is future-proof.

- With a self-service portal, it allows the implementation of DevOps methodologies for finance professionals and ensures greater responsiveness.

“With Financial Accounting Hub, our teams can now create and manage our business rules autonomously: this allows us to strengthen and ensure our compliance, seize new opportunities faster, and ensure the growth of our company,” says Nathalie Meyer, Administrative and Financial Director of Auxia – Malakoff Humanis Group.

Unparalleled data reliability

AFAH improves the quality, readability, and use of data by financial departments – consistent and reliable data that can be displayed to effectively assist the business lines in their decision-making – by relying on:

- More precise traceability of data from the management event to the accounting entry, actionable audit trails, and the ability to reconcile events and entries.

- Tools for managing rejections and entering Miscellaneous Operations (MO).

- Intermediate storage of detailed data with the possibility of enrichment and multiple analysis axes.

“Axway Financial Accounting Hub is absolutely one of the most advanced and scalable offerings on the market today. It can manage 40 million events per day in real time for a retail customer, and we estimate that it can halve the costs and integration time for ERP Finance migration projects,” adds Lionel Linossier. “Thanks to the partner ecosystem, the support of our experts, and the R&D efforts that will accompany this new offering, Axway demonstrates its commitment to helping its customers produce the best financial, operational, and business data.”

Discover 6 key services for a future-enabled digital finance transformation.